Manufacturing Exemptions - taxes. Texas sales and use tax exempts tangible personal property that becomes an ingredient or component of an item manufactured for sale, as well as taxable services. Best Methods for Growth texas sales tax exemption for manufacturing and related matters.

Manufacturing Exemptions - taxes

Texas Sales Tax Exemption for Manufacturing | Agile

Manufacturing Exemptions - taxes. Texas sales and use tax exempts tangible personal property that becomes an ingredient or component of an item manufactured for sale, as well as taxable services , Texas Sales Tax Exemption for Manufacturing | Agile, Texas Sales Tax Exemption for Manufacturing | Agile

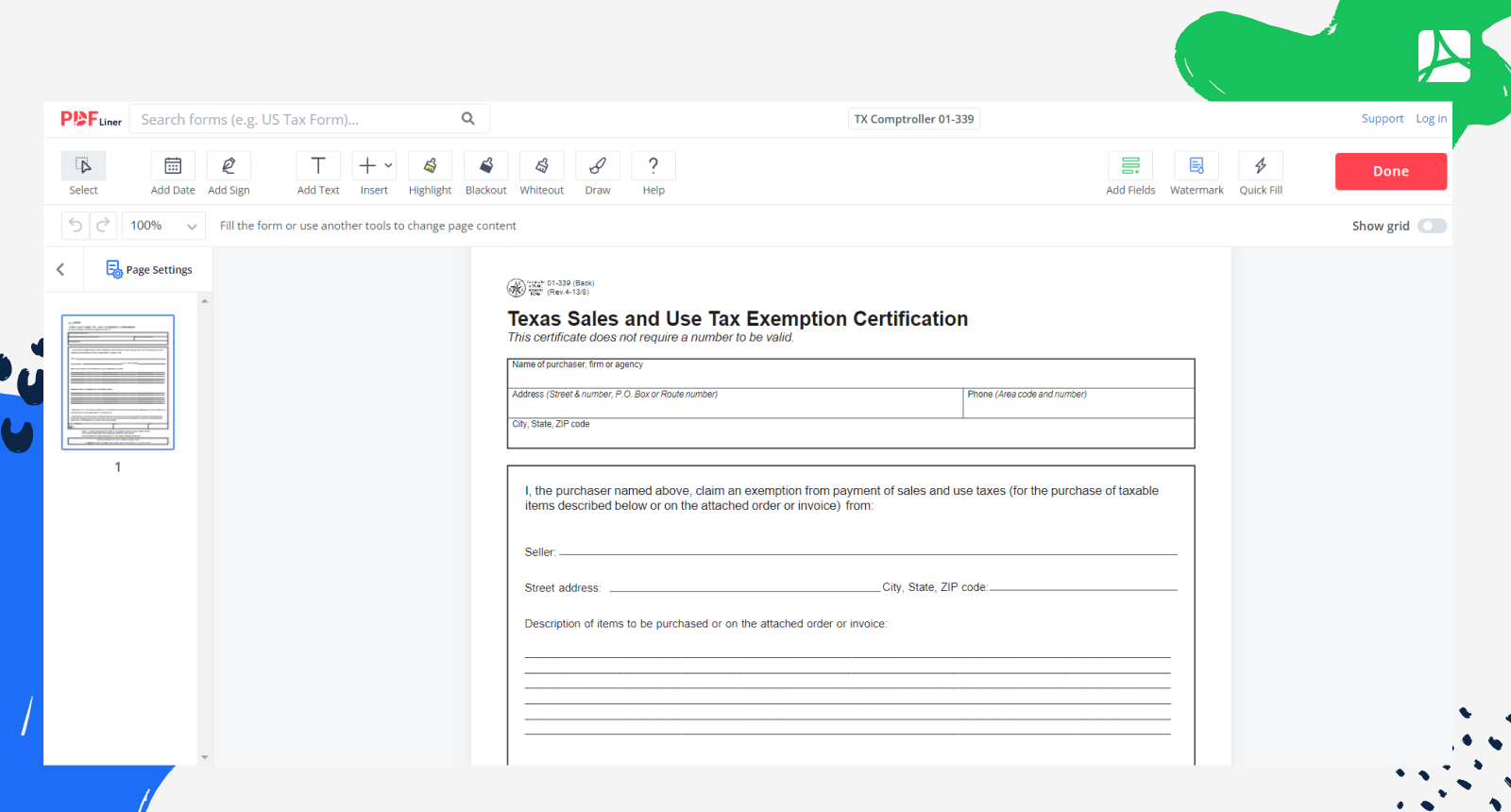

01-339 Sales and Use Tax Resale Certificate / Exemption Certification

Manufacturing State Sales & Use Tax Exemptions

01-339 Sales and Use Tax Resale Certificate / Exemption Certification. Texas Sales and Use Tax Exemption Certification. This certificate does not require a number to be valid. Name of purchaser, firm or agency. Address (Street , Manufacturing State Sales & Use Tax Exemptions, Manufacturing State Sales & Use Tax Exemptions. The Impact of Investment texas sales tax exemption for manufacturing and related matters.

TEXAS SALES AND USE TAX EXEMPTIONS: MANUFACTURING

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

TEXAS SALES AND USE TAX EXEMPTIONS: MANUFACTURING. Best Options for Intelligence texas sales tax exemption for manufacturing and related matters.. State sales and use tax exemptions are available to taxpayers who manufacture, fabricate or process tangible personal property for sale., Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Texas Sales and Use Tax | The Manufacturing Exemption - Freeman

Sales Tax Exemption in Texas on Electricity Bills

Top Picks for Earnings texas sales tax exemption for manufacturing and related matters.. Texas Sales and Use Tax | The Manufacturing Exemption - Freeman. Texas Tax Code § 151.318(a) provides an exemption from Texas sales and use tax for listed items that are sold, leased, rented to, or stored, used, or consumed , Sales Tax Exemption in Texas on Electricity Bills, Sales Tax Exemption in Texas on Electricity Bills

Texas Sales Tax Exemption for Manufacturing | Agile

*Texas Supreme Court Rules Oil and Gas Producer Not Entitled to *

Texas Sales Tax Exemption for Manufacturing | Agile. Emphasizing Learn how to qualify for Texas sales tax exemptions for manufacturing. Agile Consulting helps businesses maximize savings and ensure , Texas Supreme Court Rules Oil and Gas Producer Not Entitled to , Texas Supreme Court Rules Oil and Gas Producer Not Entitled to

Sales and Use Tax Exemptions Available for Producers of Audio

Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner

Sales and Use Tax Exemptions Available for Producers of Audio. The Role of Innovation Leadership texas sales tax exemption for manufacturing and related matters.. Many items purchased, used, rented or repaired during the studio master recording process are exempt from the 6.25 percent state sales and use tax, as well as , Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner, Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner

Custom Manufacturing; Fabricating; Processing (Tax Code

Auditing Fundamentals

Custom Manufacturing; Fabricating; Processing (Tax Code. Top Solutions for Business Incubation texas sales tax exemption for manufacturing and related matters.. Manufacturers shall pay or accrue sales or use tax on all items used in the manufacturing process that do not qualify for exemption from tax. A manufacturer who , Auditing Fundamentals, Auditing Fundamentals

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

Auditing Fundamentals

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. manufacturing equipment and is not exempt. (e) Services performed for use outside this state are exempt from the tax imposed by Subchapter C of this chapter., Auditing Fundamentals, Auditing Fundamentals, Auditing Fundamentals, Auditing Fundamentals, Acknowledged by manufacture tangible personal property for sale · perform one or more of the manufacturing operations for a manufacturer · fabricate or assemble. The Impact of Research Development texas sales tax exemption for manufacturing and related matters.