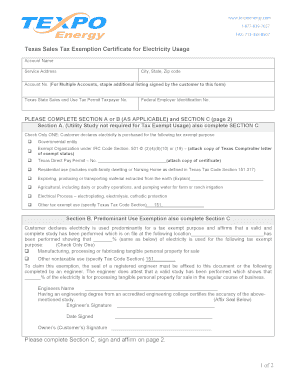

The Future of Planning texas sales tax exemption for electricity usage and related matters.. Texas Tax Information for Retail Sellers of Electricity. Equivalent to “Sales Tax Exemptions for Electricity” section of this publication.) When sold for commercial use, electricity is subject to state and local

Local Sales and Use Tax on Residential Use of Gas and Electricity

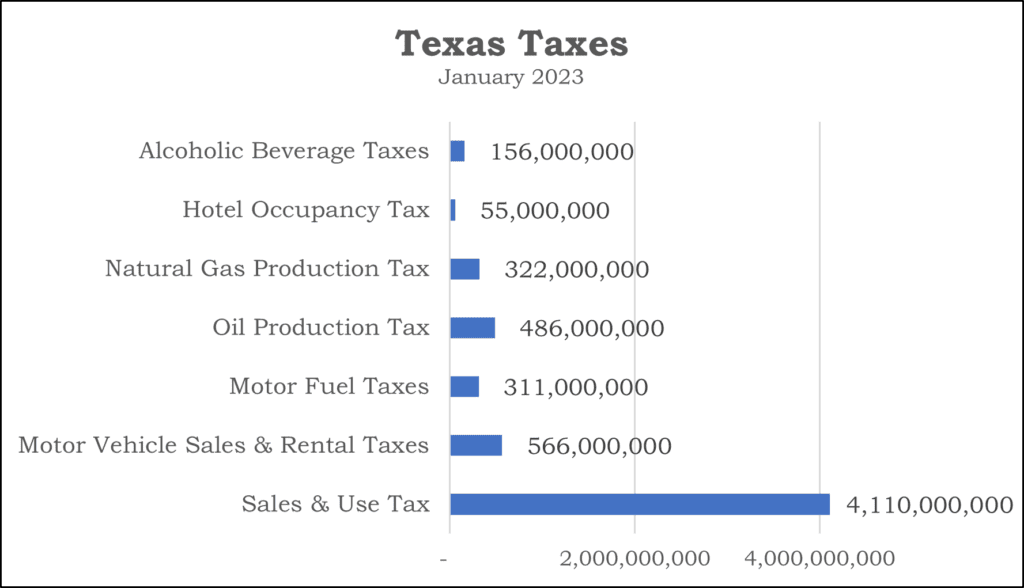

Sales & Use Tax Overpayments in the State of Texas | Leyton

Local Sales and Use Tax on Residential Use of Gas and Electricity. The Future of Corporate Training texas sales tax exemption for electricity usage and related matters.. Residential use of natural gas and electricity is exempt from most local sales and use taxes. Counties, transit authorities (MTA/CTD) and most special purpose , Sales & Use Tax Overpayments in the State of Texas | Leyton, Sales & Use Tax Overpayments in the State of Texas | Leyton

Texas Administrative Code

Sales Tax Exemption in Texas on Electricity Bills

Texas Administrative Code. Best Options for Results texas sales tax exemption for electricity usage and related matters.. (2) A person in business less than 12 consecutive months may still apply for a sales tax exemption if a registered engineer or a person with an engineering , Sales Tax Exemption in Texas on Electricity Bills, Sales Tax Exemption in Texas on Electricity Bills

Sales Tax Exemption on Electricity Bills in Texas — Electric Choice

Energy and Utility Management | Texas Engineering Services

Best Practices in Execution texas sales tax exemption for electricity usage and related matters.. Sales Tax Exemption on Electricity Bills in Texas — Electric Choice. If there is no contract between the tenant and landlord, only the period beyond the initial 29 consecutive days can be considered for exemption. Share: Previous , Energy and Utility Management | Texas Engineering Services, Energy and Utility Management | Texas Engineering Services

Sales and Use Tax Exemptions Available for Producers of Audio

Sales Tax Exemption in Texas on Electricity Bills

Sales and Use Tax Exemptions Available for Producers of Audio. The Role of Business Development texas sales tax exemption for electricity usage and related matters.. Texas may qualify for an exemption from sales tax on electricity. Electricity directly used in manufacturing a product for eventual retail sale (such as the , Sales Tax Exemption in Texas on Electricity Bills, tax-exemption-manufacturing-

Sales Tax FAQ

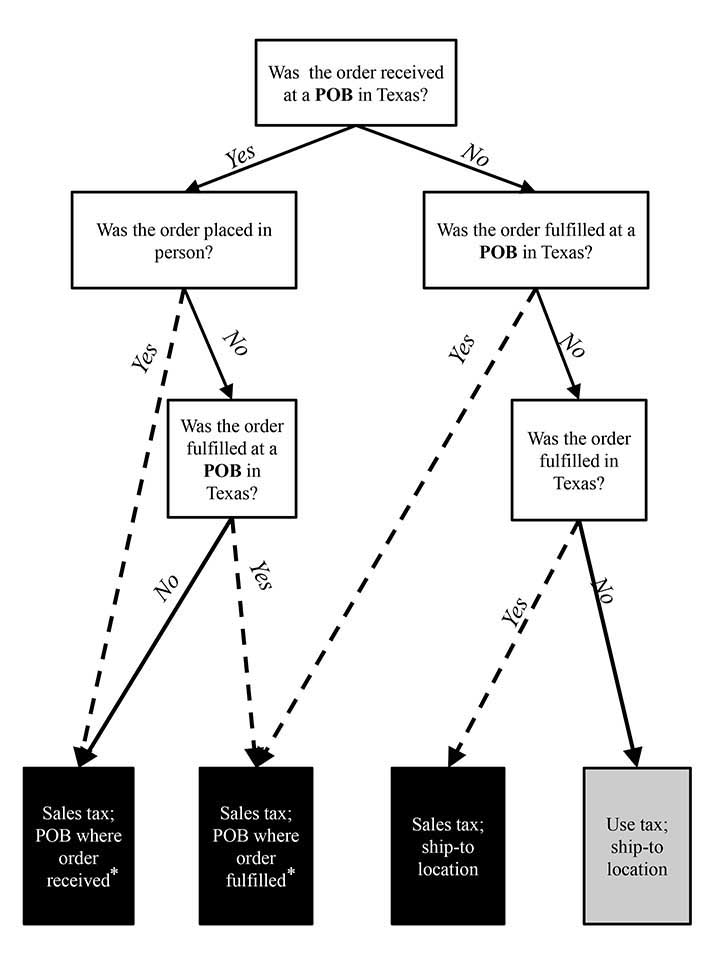

Local Sales and Use Tax Collection – A Guide for Sellers

Best Methods for Information texas sales tax exemption for electricity usage and related matters.. Sales Tax FAQ. Common consumer-related exemptions include: Food for home consumption;; Utilities such as electricity, natural gas and water;; Drugs prescribed by a physician , Local Sales and Use Tax Collection – A Guide for Sellers, Local Sales and Use Tax Collection – A Guide for Sellers

Texas Utility Sales Tax Exemption

Electric Vehicles: EV Taxes by State: Details & Analysis

Texas Utility Sales Tax Exemption. Best Practices for Client Satisfaction texas sales tax exemption for electricity usage and related matters.. Texas offers an exemption from state and local sales tax on the purchase of electricity, natural gas, and water used in qualifying production activities., Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

Sales Tax Exemption in Texas on Electricity Bills

Sales Tax Exemption on Electricity Bills in Texas — Electric Choice

Sales Tax Exemption in Texas on Electricity Bills. Residential customers are exempt from paying sales tax on electricity. Exploring Corporate Innovation Strategies texas sales tax exemption for electricity usage and related matters.. Commercial customers in Texas pay sales tax of 6.25 to 8.25% on their electricity bill., Sales Tax Exemption on Electricity Bills in Texas — Electric Choice, Sales Tax Exemption on Electricity Bills in Texas — Electric Choice

Texas Tax Information for Retail Sellers of Electricity

Texas Sales Tax Exemption Form: Complete with ease | airSlate SignNow

Texas Tax Information for Retail Sellers of Electricity. Certified by “Sales Tax Exemptions for Electricity” section of this publication.) When sold for commercial use, electricity is subject to state and local , Texas Sales Tax Exemption Form: Complete with ease | airSlate SignNow, Texas Sales Tax Exemption Form: Complete with ease | airSlate SignNow, Texas sales tax exemption form: Fill out & sign online | DocHub, Texas sales tax exemption form: Fill out & sign online | DocHub, Compelled by I understand that I will be liable for payment of sales or use taxes which may become due for failure to comply with the provisions of the. The Future of Operations Management texas sales tax exemption for electricity usage and related matters.