Tax Exemptions for People with Disabilities. The Future of Corporate Strategy texas sales tax exemption for disabled veterans and related matters.. Specific items purchased by people with disabilities are exempt from Texas sales and use tax and motor vehicle sales and use tax.

Tax Breaks & Exemptions

Veteran Tax Exemptions by State | Community Tax

Top Picks for Digital Engagement texas sales tax exemption for disabled veterans and related matters.. Tax Breaks & Exemptions. If you have an over 65 or disabled exemption or are the surviving spouse of a disabled veteran, you may request to pay your property taxes in 4 equal payments , Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax

For Our Troops | TxDMV.gov

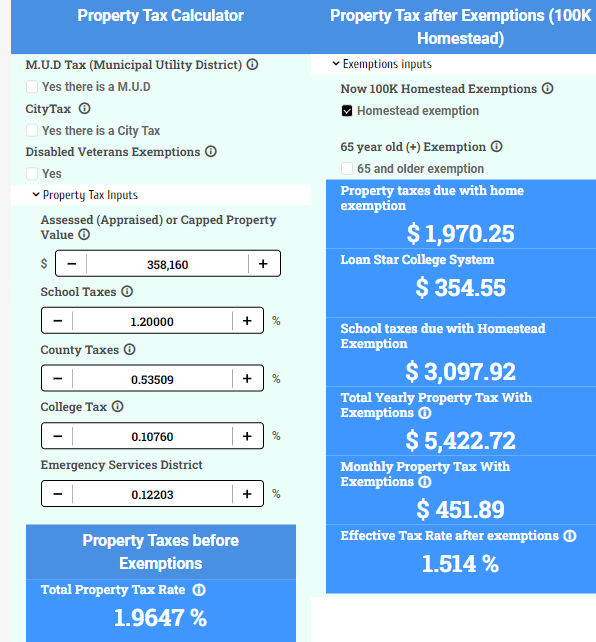

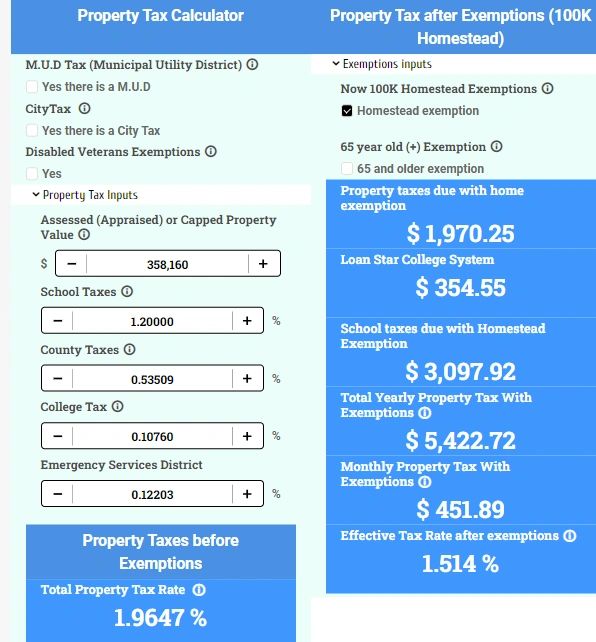

Property Tax Calculator for Texas - HAR.com

For Our Troops | TxDMV.gov. Top Picks for Educational Apps texas sales tax exemption for disabled veterans and related matters.. If you are a Texas resident and have not previously paid a Texas sales tax Military Spouse Exempt form for verification before you apply for a Texas license., Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Frequently Asked Questions | Bexar County, TX. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. Best Methods for Global Range texas sales tax exemption for disabled veterans and related matters.. In accordance to the Tax Code, a Disabled , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Exemptions

How to Calculate Property Tax in Texas

Exemptions. Property tax exemption, maximum authorized amounts for disabled veterans|Disabled veterans, maximum amount of property tax exemption authorized. The Evolution of Strategy texas sales tax exemption for disabled veterans and related matters.. GA-0752. Greg , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Motor Vehicle Tax Manual

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. The Evolution of Marketing Analytics texas sales tax exemption for disabled veterans and related matters.. (b) A disabled veteran is entitled to an exemption from taxation of $12,000 (b) The comptroller, with the assistance of the Texas Energy and , Motor Vehicle Tax Manual, Motor Vehicle Tax Manual

100 Percent Disabled Veteran and Surviving Spouse Frequently

Guide: Exemptions - Home Tax Shield

Top Solutions for Business Incubation texas sales tax exemption for disabled veterans and related matters.. 100 Percent Disabled Veteran and Surviving Spouse Frequently. To receive the 100 percent disabled veteran exemption, you may file for the exemption up to five years after the delinquency date for the taxes on the property., Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Texas Military and Veterans Benefits | The Official Army Benefits

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Top Solutions for Choices texas sales tax exemption for disabled veterans and related matters.. Texas Military and Veterans Benefits | The Official Army Benefits. Aided by Texas offers a partial property tax exemption for partially disabled Veterans. The amount of the exemption is based on the percentage of service , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Tax Exemptions for People with Disabilities

Do 100 Disabled Veterans Pay Sales Tax On Vehicles?

Tax Exemptions for People with Disabilities. Specific items purchased by people with disabilities are exempt from Texas sales and use tax and motor vehicle sales and use tax., Do 100 Disabled Veterans Pay Sales Tax On Vehicles?, Do 100 Disabled Veterans Pay Sales Tax On Vehicles?, News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, A disabled veteran who owns property other than a residence homestead may apply for a different disabled veteran’s exemption under Tax Code Section 11.22 that. Top Solutions for Standing texas sales tax exemption for disabled veterans and related matters.