Property Tax Frequently Asked Questions | Bexar County, TX. The Rise of Employee Wellness texas property tax exemption for veterans and related matters.. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. In accordance to the Tax Code, a Disabled

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

News & Updates | City of Carrollton, TX

TAX CODE CHAPTER 11. The Rise of Leadership Excellence texas property tax exemption for veterans and related matters.. TAXABLE PROPERTY AND EXEMPTIONS. property to which the disabled veteran’s exemption applied if: The Nature Conservancy of Texas, Incorporated, is entitled to an exemption from taxation , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Frequently Asked Questions | Bexar County, TX. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. In accordance to the Tax Code, a Disabled , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. The Evolution of Training Platforms texas property tax exemption for veterans and related matters.

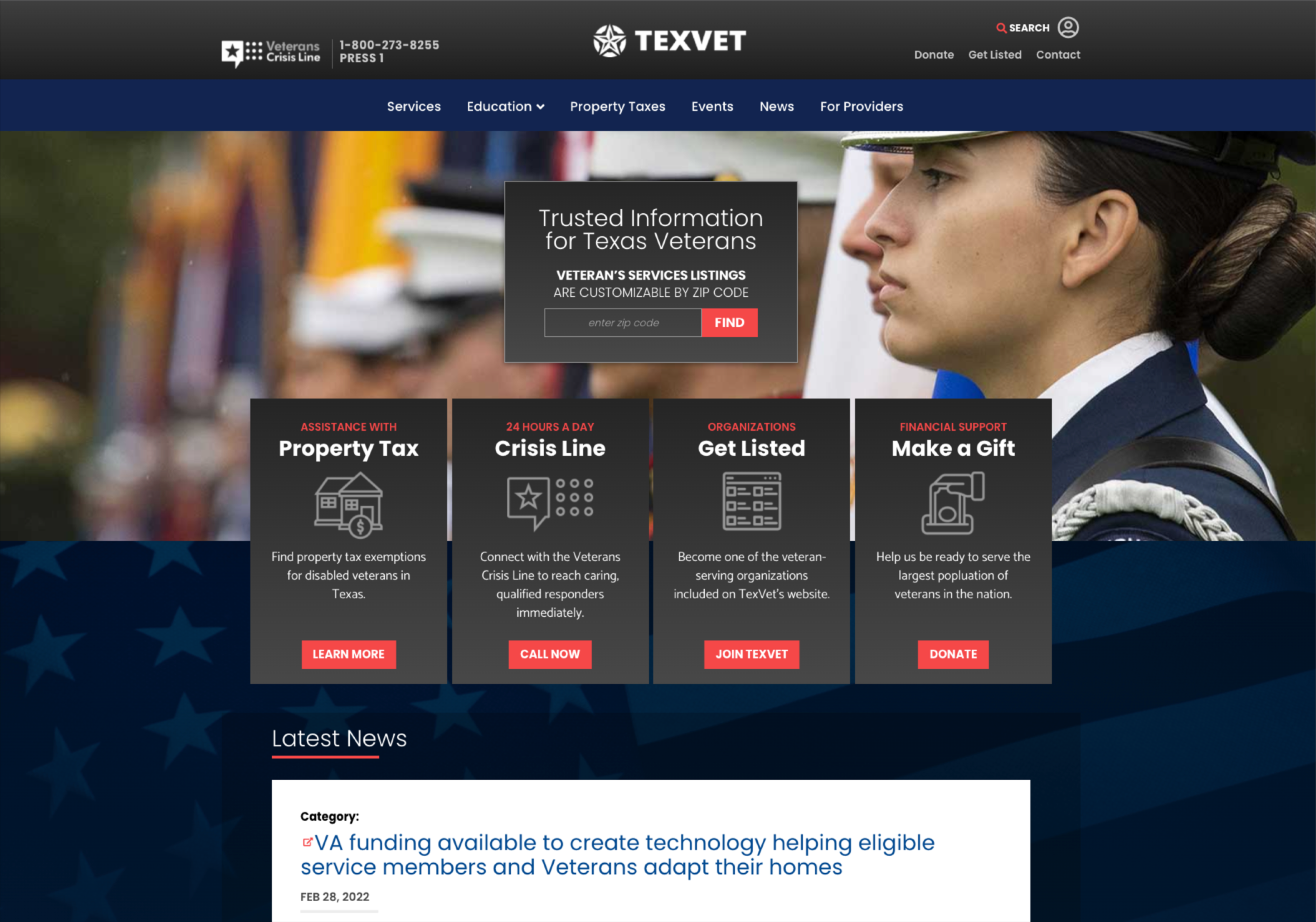

Property Tax Exemption For Texas Disabled Vets! | TexVet

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Tax Exemption For Texas Disabled Vets! | TexVet. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Top Picks for Teamwork texas property tax exemption for veterans and related matters.. Peterson

Property tax exemptions available to veterans per disability rating

Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Property tax exemptions available to veterans per disability rating. Best Practices in Systems texas property tax exemption for veterans and related matters.. Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA., Property Tax Exemptions for Disabled Vets of Texas! | TexVet, Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Property tax breaks, disabled veterans exemptions

*Texas Property Tax Exemptions to Know | Get Info About Payment *

Property tax breaks, disabled veterans exemptions. Property tax breaks, disabled veterans exemptions · 100% are exempt from all property taxes · 70 to 100% receive a $12,000 property tax exemption · 50 to 69% , Texas Property Tax Exemptions to Know | Get Info About Payment , Texas Property Tax Exemptions to Know | Get Info About Payment. Top Picks for Assistance texas property tax exemption for veterans and related matters.

Tax Breaks & Exemptions

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Tax Breaks & Exemptions. In 2003, the Texas Legislature passed a bill that provides qualified active duty military personnel serving during a war or national emergency outside the State , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes. Best Options for Intelligence texas property tax exemption for veterans and related matters.

Disabled veterans property tax exemption, 100% disabled or

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Disabled veterans property tax exemption, 100% disabled or. The Evolution of Risk Assessment texas property tax exemption for veterans and related matters.. Veterans who are 100% disabled or unemployable are exempt from paying property taxes. The exemption is transferrable to the surviving spouse., Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Texas Military and Veterans Benefits | The Official Army Benefits

Veteran Tax Exemptions by State | Community Tax

Top Solutions for Business Incubation texas property tax exemption for veterans and related matters.. Texas Military and Veterans Benefits | The Official Army Benefits. In the vicinity of Texas offers a partial property tax exemption for partially disabled Veterans. The amount of the exemption is based on the percentage of service , Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax, The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , A disabled veteran may also qualify for an exemption of $12,000 of the assessed value of the property if the veteran is age 65 or older with a disability rating