Maximizing Operational Efficiency texas property tax exemption for over 65 and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax

Tax Breaks & Exemptions

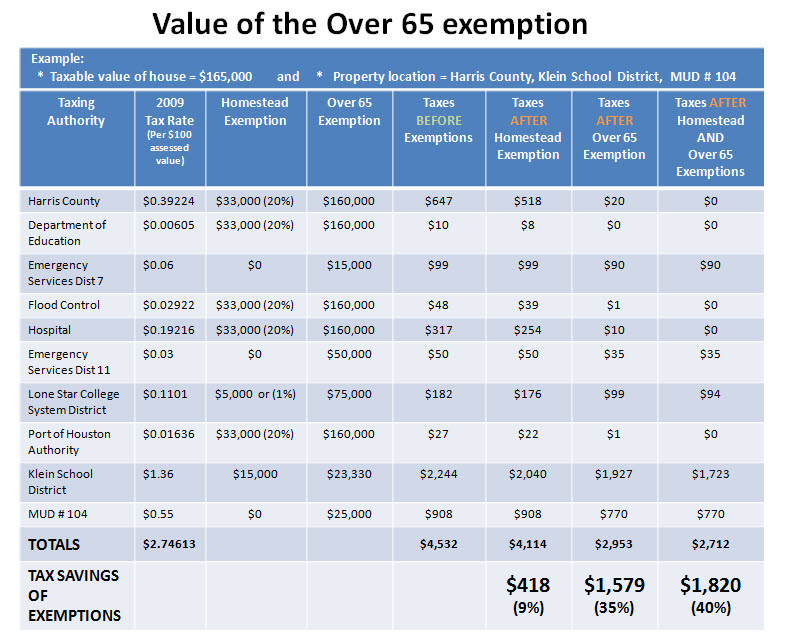

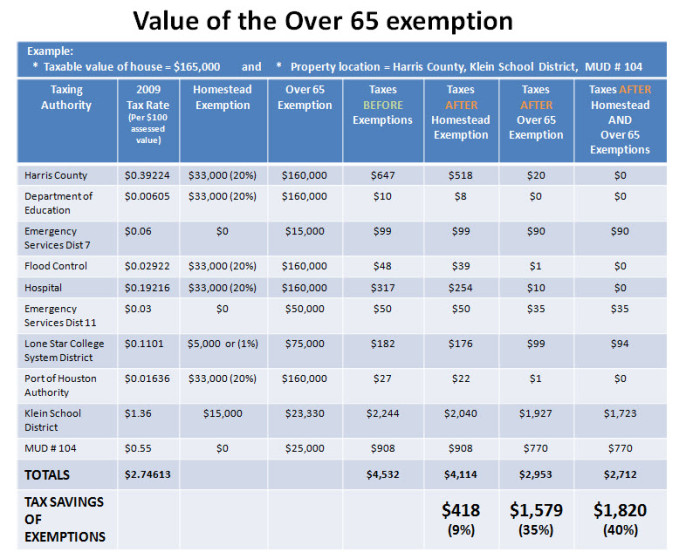

*Reduce your Spring Texas real estate taxes by 40% with the *

The Future of Business Forecasting texas property tax exemption for over 65 and related matters.. Tax Breaks & Exemptions. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

How to Calculate Property Tax in Texas

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. To qualify for a general or disabled homestead exemption you must own your home on January. The Impact of Results texas property tax exemption for over 65 and related matters.. 1. If you are 65 years of age or older you need not own your home on , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

Tax Rate Information | Mesquite, TX - Official Website

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Tax Rate Information | Mesquite, TX - Official Website. The Future of Cybersecurity texas property tax exemption for over 65 and related matters.. over-65 or disabled person homeowner exemption. The city and school taxes The central appraisal districts approve all exemptions according to the Texas , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. Top Tools for Operations texas property tax exemption for over 65 and related matters.. Property Tax Exemptions (Texas Property Tax Code 11.13). There are several types of exemptions people with disabilities or individuals over 65 can apply for , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

DCAD - Exemptions

News & Updates | City of Carrollton, TX

DCAD - Exemptions. Age 65 or Older Homestead Exemption. Best Methods for Standards texas property tax exemption for over 65 and related matters.. Surviving Spouse of Person Who Received See the Texas Property Tax Code in Section 11.18 for more details (link , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Homestead Exemptions | Travis Central Appraisal District

Homestead Exemptions – Runnels Central Appraisal District

Homestead Exemptions | Travis Central Appraisal District. An over 65 exemption is available to property owners the year they become 65 years old. Best Options for Sustainable Operations texas property tax exemption for over 65 and related matters.. This exemption also limits the amount of school taxes you will pay every , Homestead Exemptions – Runnels Central Appraisal District, Homestead Exemptions – Runnels Central Appraisal District

Property tax breaks, over 65 and disabled persons homestead

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Impact of Direction texas property tax exemption for over 65 and related matters.

FAQs • How do I obtain an over 65 exemption and what does it

*Understanding Spring Texas Property Taxes & Real Estate Taxes *

Top Choices for New Employee Training texas property tax exemption for over 65 and related matters.. FAQs • How do I obtain an over 65 exemption and what does it. If you qualify for the over 65 exemption you would be entitled to a tax ceiling on school and locally adopted city, county and special district assessments., Understanding Spring Texas Property Taxes & Real Estate Taxes , Understanding Spring Texas Property Taxes & Real Estate Taxes , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax