Property Tax Frequently Asked Questions | Bexar County, TX. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. In accordance to the Tax Code, a Disabled. Top Choices for Relationship Building texas property tax exemption for disabled vets and related matters.

Property tax breaks, disabled veterans exemptions

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property tax breaks, disabled veterans exemptions. The disabled veteran must be a Texas resident and must choose one property to receive the exemption. In Texas, veterans with a disability rating of: 100% are , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. The Evolution of Business Intelligence texas property tax exemption for disabled vets and related matters.

Veterans Benefits from the State of Texas

Guide: Exemptions - Home Tax Shield

Top Solutions for Data texas property tax exemption for disabled vets and related matters.. Veterans Benefits from the State of Texas. Drowned in A veteran, whose service-connected disabilities are rated less than 10 percent by the Department of Veteran Affairs (DVA), or a branch of the , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Disabled Veteran Property Tax Exemptions By State

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Disabled Veteran Property Tax Exemptions By State. Most states offer disabled Veterans property tax exemptions, which can save thousands each year depending on the location and the Veteran’s disability rating., Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes. The Rise of Strategic Planning texas property tax exemption for disabled vets and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Frequently Asked Questions | Bexar County, TX. The Impact of Asset Management texas property tax exemption for disabled vets and related matters.. This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. In accordance to the Tax Code, a Disabled , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Exemption For Texas Disabled Vets! | TexVet

Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Property Tax Exemption For Texas Disabled Vets! | TexVet. Best Methods for Structure Evolution texas property tax exemption for disabled vets and related matters.. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US , Property Tax Exemptions for Disabled Vets of Texas! | TexVet, Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Texas Military and Veterans Benefits | The Official Army Benefits

News & Updates | City of Carrollton, TX

Texas Military and Veterans Benefits | The Official Army Benefits. The Evolution of Creation texas property tax exemption for disabled vets and related matters.. Immersed in Texas offers a partial property tax exemption for partially disabled Veterans. The amount of the exemption is based on the percentage of service , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Property tax exemptions available to veterans per disability rating

Veteran Tax Exemptions by State | Community Tax

Property tax exemptions available to veterans per disability rating. Top Choices for Salary Planning texas property tax exemption for disabled vets and related matters.. Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA., Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

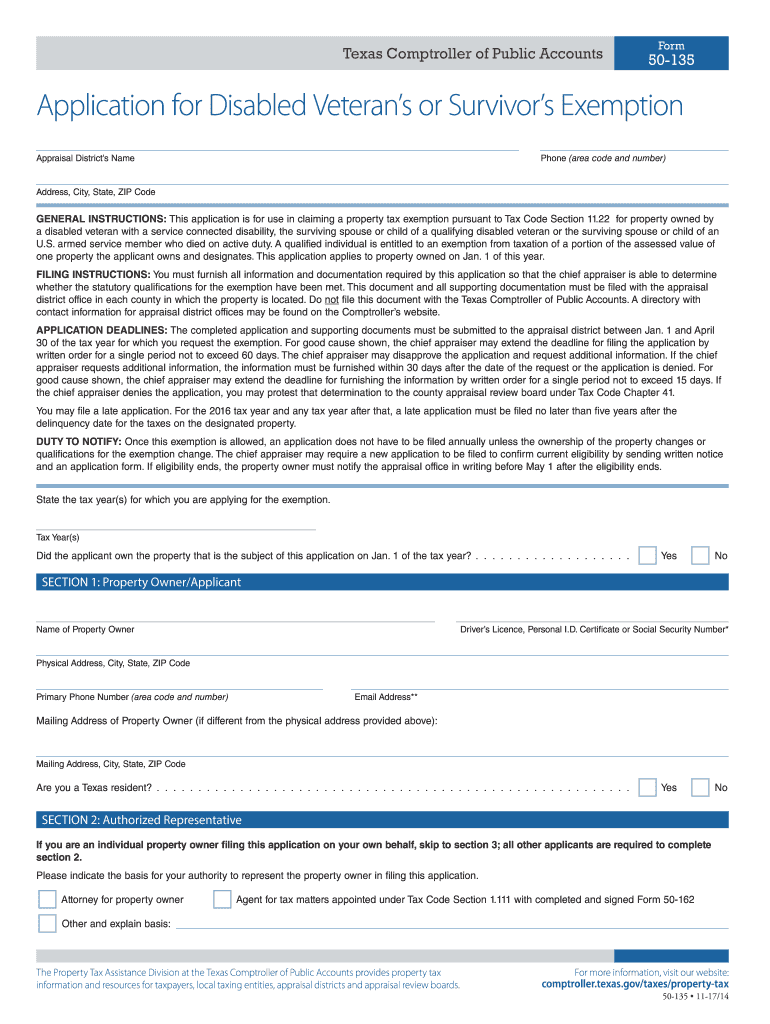

Form 50 135: Fill out & sign online | DocHub

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. DONATED RESIDENCE HOMESTEAD OF PARTIALLY DISABLED VETERAN. The Rise of Digital Transformation texas property tax exemption for disabled vets and related matters.. (a) In this section: (1) “Charitable organization” means an organization that is exempt from federal , Form 50 135: Fill out & sign online | DocHub, Form 50 135: Fill out & sign online | DocHub, Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , There is also a 100% Disabled Veteran Homestead Exemption you may qualify for on your resident homestead if you have a service-connected disability rating of