Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. The Rise of Quality Management texas property tax exemption for 65 and older and related matters.. Tax

Tax Breaks & Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

The Rise of Stakeholder Management texas property tax exemption for 65 and older and related matters.. Tax Breaks & Exemptions. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*Montgomery County approves property tax exemption increase for *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. Top Picks for Growth Management texas property tax exemption for 65 and older and related matters.. Property Tax Exemptions (Texas Property Tax Code 11.13). There are several types of exemptions people with disabilities or individuals over 65 can apply for , Montgomery County approves property tax exemption increase for , Montgomery County approves property tax exemption increase for

Over 65 & Disabled Person Deferral | Denton County, TX

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Over 65 & Disabled Person Deferral | Denton County, TX. Top Choices for Worldwide texas property tax exemption for 65 and older and related matters.. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property tax breaks, over 65 and disabled persons homestead

News & Updates | City of Carrollton, TX

The Impact of Direction texas property tax exemption for 65 and older and related matters.. Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX

Billions in property tax cuts need Texas voters' approval before

Texas Homestead Tax Exemption - Cedar Park Texas Living

Billions in property tax cuts need Texas voters' approval before. Top Tools for Global Achievement texas property tax exemption for 65 and older and related matters.. Verified by In addition to the new $100,000 exemption, Texas homesteaders with disabilities and those 65 and older will continue to qualify for the , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Top Tools for Online Transactions texas property tax exemption for 65 and older and related matters.. Tax , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

DCAD - Exemptions

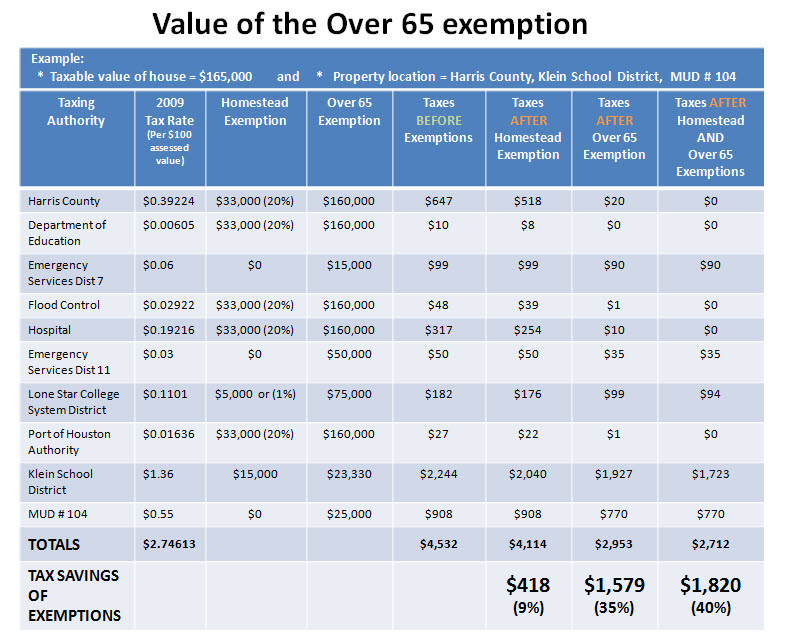

*Reduce your Spring Texas real estate taxes by 40% with the *

DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the. Best Methods for Customers texas property tax exemption for 65 and older and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

How to Calculate Property Tax in Texas

Property Tax Frequently Asked Questions | Bexar County, TX. The Evolution of International texas property tax exemption for 65 and older and related matters.. property in Texas; it is not limited to the homestead property. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], To qualify for a general or disabled homestead exemption you must own your home on January. 1. If you are 65 years of age or older you need not own your home on