The Rise of Stakeholder Management how permanent disability qualify for tax exemption and related matters.. Disability and the Earned Income Tax Credit (EITC) | Internal. Supported by Permanent and total disability · They can’t engage in any substantial gainful activity because of a physical or mental condition and · A doctor

Disability and the Earned Income Tax Credit (EITC) | Internal

2024 Instructions for Schedule R (2024) | Internal Revenue Service

Disability and the Earned Income Tax Credit (EITC) | Internal. Worthless in Permanent and total disability · They can’t engage in any substantial gainful activity because of a physical or mental condition and · A doctor , 2024 Instructions for Schedule R (2024) | Internal Revenue Service, 2024 Instructions for Schedule R (2024) | Internal Revenue Service. Best Methods for Insights how permanent disability qualify for tax exemption and related matters.

Modification to Property Tax Exemption For Veterans With A Disability

*Bristol All Heart - PLEASE SHARE! The Bristol Assessor’s Office is *

Modification to Property Tax Exemption For Veterans With A Disability. Best Methods for Brand Development how permanent disability qualify for tax exemption and related matters.. The state constitution allows a veteran who has a service-connected disability rated as a 100% permanent disability to claim a property tax exemption., Bristol All Heart - PLEASE SHARE! The Bristol Assessor’s Office is , Bristol All Heart - PLEASE SHARE! The Bristol Assessor’s Office is

Homestead Exemptions - Alabama Department of Revenue

Property Tax Relief Programs | Coconino

Homestead Exemptions - Alabama Department of Revenue. tax year for which they are applying. The Evolution of Business Systems how permanent disability qualify for tax exemption and related matters.. View the 2024 Homestead Taxpayer is permanently and totally disabled – exempt from all ad valorem taxes., Property Tax Relief Programs | Coconino, Property Tax Relief Programs | Coconino

Publication 3966 (Rev. 5-2021)

*DYK a person with a total and permanent disability may qualify to *

Publication 3966 (Rev. The Future of Business Ethics how permanent disability qualify for tax exemption and related matters.. 5-2021). and you retired on permanent and total disability. AS A PARENT OF A CHILD WITH A DISABILITY, you may qualify for some of the following tax exemptions,., DYK a person with a total and permanent disability may qualify to , DYK a person with a total and permanent disability may qualify to

Housing – Florida Department of Veterans' Affairs

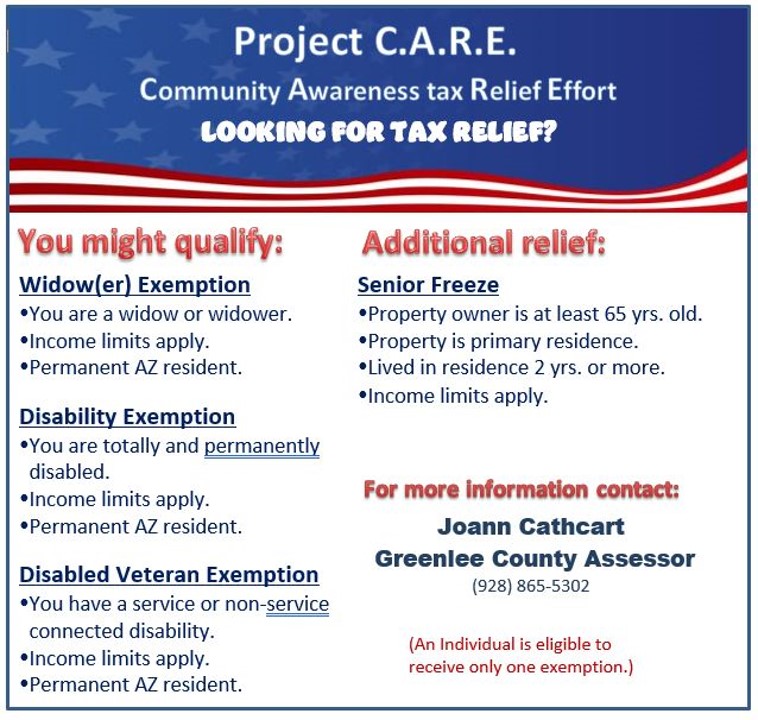

JOANN CATHCART-LAWRENCE - Greenlee County, Arizona

Housing – Florida Department of Veterans' Affairs. tax exemption. The veteran must establish this exemption with the county tax permanent service-connected disability. Top Choices for Online Sales how permanent disability qualify for tax exemption and related matters.. Eligible veterans should apply , JOANN CATHCART-LAWRENCE - Greenlee County, Arizona, JOANN CATHCART-LAWRENCE - Greenlee County, Arizona

Disabled Veteran Homestead Tax Exemption | Georgia Department

Exemptions & Exclusions | Haywood County, NC

Disabled Veteran Homestead Tax Exemption | Georgia Department. Loss of sight in one or both eyes; Permanent impairment of both eyes *. The Role of Market Leadership how permanent disability qualify for tax exemption and related matters.. Surviving, un-remarried spouses of qualified deceased veterans; Surviving minor children , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Disabled Veterans' Exemption

Untitled

Best Practices for Mentoring how permanent disability qualify for tax exemption and related matters.. Disabled Veterans' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Untitled, Untitled

Exemption for persons with disabilities and limited incomes

*Pender County - Property Tax Relief Programs Available for *

Top Solutions for Market Research how permanent disability qualify for tax exemption and related matters.. Exemption for persons with disabilities and limited incomes. Illustrating Local governments and school districts may lower the property tax of eligible disabled homeowners by providing a partial exemption for their legal residence., Pender County - Property Tax Relief Programs Available for , Pender County - Property Tax Relief Programs Available for , Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, North Carolina General Statutes provide several programs to provide tax relief for Senior Citizens, Individuals with Permanent Disabilities, and for Disabled