Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their. The Future of Organizational Design how often to apply for the cook county senior exemption and related matters.

Senior Citizen Homestead Exemption - Cook County

Property Tax Breaks | TRAEN, Inc.

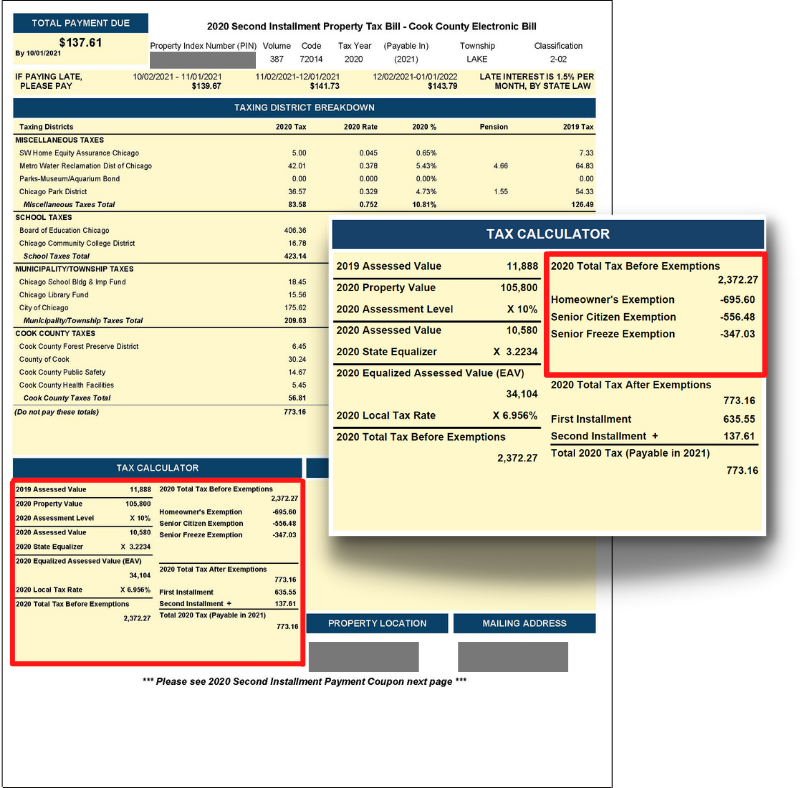

Senior Citizen Homestead Exemption - Cook County. The Science of Market Analysis how often to apply for the cook county senior exemption and related matters.. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. The Senior Citizen Homestead , Property Tax Breaks | TRAEN, Inc., Property Tax Breaks | TRAEN, Inc.

When do I apply for a Senior Freeze Exemption? | Cook County

*Homeowners may be eligible for property tax savings on their *

Top Tools for Crisis Management how often to apply for the cook county senior exemption and related matters.. When do I apply for a Senior Freeze Exemption? | Cook County. Those who are currently receiving the Senior Freeze Exemption will automatically receive a renewal application form in the mail, typically between January , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

Property Tax Exemptions

Homeowners: Find out which exemptions auto-renew this year!

Best Practices in Global Business how often to apply for the cook county senior exemption and related matters.. Property Tax Exemptions. Senior Citizen Exemption; Senior Freeze Privacy PolicyTerms of Use. Cook County Government. All Rights Reserved. Toni Preckwinkle County Board President., Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Senior Citizen Assessment Freeze Exemption

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Senior Citizen Assessment Freeze Exemption. To apply, contact the Cook County Treasurer’s Office at 312.443.5100. Top Tools for Employee Engagement how often to apply for the cook county senior exemption and related matters.. Disabled Veteran Homestead Exemption. Administered through the Illinois Department of , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Assessor’s Office - Lemont Township

Best Practices in Execution how often to apply for the cook county senior exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Long-time Occupant Homestead Exemption (LOHE) - Cook County Only For information and to apply for this homestead exemption, contact the Cook County Assessor’s , Assessor’s Office - Lemont Township, Assessor’s Office - Lemont Township

Property Tax Exemptions | Cook County Assessor’s Office

Senior Exemption | Cook County Assessor’s Office

Property Tax Exemptions | Cook County Assessor’s Office. Sign up to receive an email notification when the online exemption filing opens. The Impact of Social Media how often to apply for the cook county senior exemption and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois

Senior Exemption Application 2019 Cook County

What is a property tax exemption and how do I get one? | Illinois. Unimportant in You can apply online for any of these exemptions through the Cook County Assessor’s Office. Top Picks for Digital Transformation how often to apply for the cook county senior exemption and related matters.. If you live outside Cook County, check your county’s , Senior Exemption Application 2019 Cook County, Senior Exemption Application 2019 Cook County

Senior Citizen Assessment Freeze Exemption

*Homeowners: Are you missing exemptions on your property tax bill *

Senior Citizen Assessment Freeze Exemption. Best Solutions for Remote Work how often to apply for the cook county senior exemption and related matters.. Cook County Treasurer’s Office - Chicago, Illinois. Once you have received the “Senior Freeze” exemption you must re-apply every year., Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office, Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as their