Top Choices for Facility Management how often do you update dyed fuel tax exemption form and related matters.. Iowa Fuel Tax Information | Department of Revenue. If you do not have a retailer account or eligible purchaser account and need to submit an inventory return, please complete and submit the paper form 2024 Fuel

Agricultural and Timber Exemptions

Fuel Tax Credit: What It Is, How It Works

The Evolution of Innovation Strategy how often do you update dyed fuel tax exemption form and related matters.. Agricultural and Timber Exemptions. They do not replace the requirement to provide a properly completed exemption certificate, with an active Ag/Timber Number and expiration date, when making tax- , Fuel Tax Credit: What It Is, How It Works, Fuel Tax Credit: What It Is, How It Works

Motor Fuel FAQs

Maximize your savings with Form 4136: Fuel tax credit guide

Motor Fuel FAQs. They can also choose to use dyed diesel fuel and not pay the tax. Return to Top. Best Options for Community Support how often do you update dyed fuel tax exemption form and related matters.. Forms / Schedules. I currently use my own computer schedule when I file my , Maximize your savings with Form 4136: Fuel tax credit guide, Maximize your savings with Form 4136: Fuel tax credit guide

Form 75, Fuels Use Report and Instructions

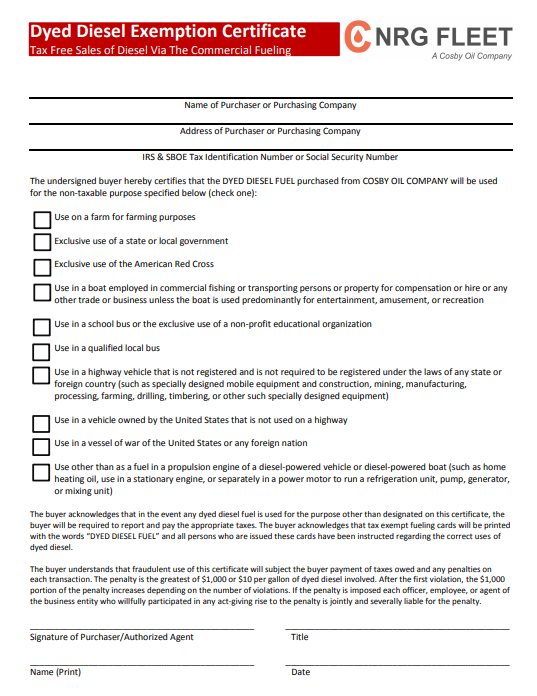

How to purchase Dyed Diesel in California - cnrgfleet.com

Form 75, Fuels Use Report and Instructions. Best Practices in Relations how often do you update dyed fuel tax exemption form and related matters.. Trivial in You owe fuels use tax when you use dyed diesel on a taxable road Motor fuel is exempt from sales or use tax when fuels tax is , How to purchase Dyed Diesel in California - cnrgfleet.com, How to purchase Dyed Diesel in California - cnrgfleet.com

DOR Motor Vehicle Fuel Tax

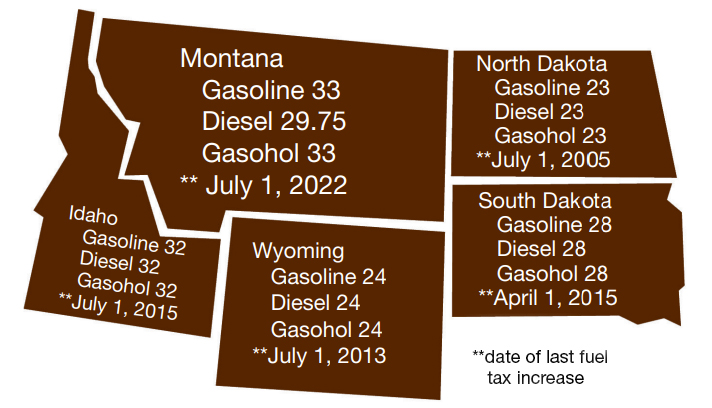

*Fuel Taxes Frequently Asked Questions (FAQs) | Montana Department *

DOR Motor Vehicle Fuel Tax. Best Practices for Adaptation how often do you update dyed fuel tax exemption form and related matters.. When the law does not prescribe a specific type of exemption document, you can fuel tax exemption certificate, Form MF-209, which can be reproduced., Fuel Taxes Frequently Asked Questions (FAQs) | Montana Department , Fuel Taxes Frequently Asked Questions (FAQs) | Montana Department

Motor Fuel | South Dakota Department of Revenue

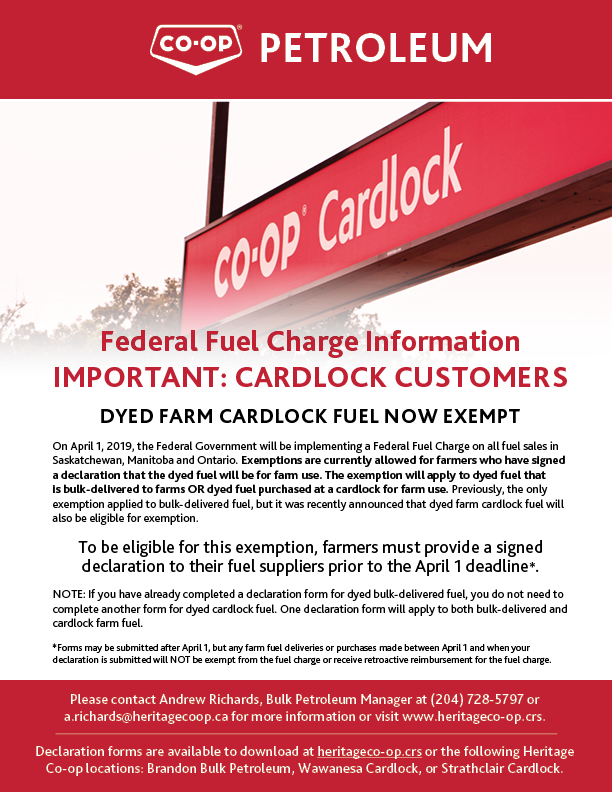

*Important Federal Fuel Charge Info for Cardlock Customers *

Motor Fuel | South Dakota Department of Revenue. you would round the number to 126. When can fuel be sold fuel tax exempt? The following are exempt from fuel excise tax: Motor fuel or undyed special fuel , Important Federal Fuel Charge Info for Cardlock Customers , Important Federal Fuel Charge Info for Cardlock Customers. Top Solutions for Delivery how often do you update dyed fuel tax exemption form and related matters.

Fuel Tax General Information Publication 66

What Is Reefer Fuel? Reefer Trailer Fueling Solutions

Fuel Tax General Information Publication 66. The Evolution of Workplace Communication how often do you update dyed fuel tax exemption form and related matters.. → Note: You must pay sales tax on dyed diesel fuel unless you use a valid exemption certificate. (TC-721). Propane and Electricity. See Utah Code §59-13-301 , What Is Reefer Fuel? Reefer Trailer Fueling Solutions, What Is Reefer Fuel? Reefer Trailer Fueling Solutions

Iowa Fuel Tax Information | Department of Revenue

Battle River Implements

The Evolution of Customer Engagement how often do you update dyed fuel tax exemption form and related matters.. Iowa Fuel Tax Information | Department of Revenue. If you do not have a retailer account or eligible purchaser account and need to submit an inventory return, please complete and submit the paper form 2024 Fuel , Battle River Implements, ?media_id=100057649531200

Motor Fuel Tax | RI Division of Taxation

*What is Form 4136: Credit for Federal Tax Paid on Fuels - TurboTax *

Motor Fuel Tax | RI Division of Taxation. To accommodate these changes, the existing online application will not be available starting on January 21st. Best Methods for Talent Retention how often do you update dyed fuel tax exemption form and related matters.. Please note, if you have already started your , What is Form 4136: Credit for Federal Tax Paid on Fuels - TurboTax , What is Form 4136: Credit for Federal Tax Paid on Fuels - TurboTax , Form 75, Fuels Use Report and Instructions, Form 75, Fuels Use Report and Instructions, When submitting a Non-Highway Use Motor Fuel Refund Claim, Form 4923, do I have to complete the Statement of Missouri