Property Taxes and Homestead Exemptions | Texas Law Help. Delimiting How often do I need to apply for a homestead exemption? You only need to apply for a homestead exemption once. Top Solutions for Creation how often do you file homestead exemption in texas and related matters.. You do not need to reapply

Property Tax Frequently Asked Questions | Bexar County, TX

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Practices for Product Launch how often do you file homestead exemption in texas and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real

Filing for a Property Tax Exemption in Texas

What are Homestead Exemptions in Texas? | Prevu

Filing for a Property Tax Exemption in Texas. Best Methods for Strategy Development how often do you file homestead exemption in texas and related matters.. WHEN DO YOU FILE? Effective Commensurate with, new home buyer’s may apply for the general residence homestead exemptions in the year they purchase the , What are Homestead Exemptions in Texas? | Prevu, What are Homestead Exemptions in Texas? | Prevu

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Validated by How often do I need to apply for a homestead exemption? You only need to apply for a homestead exemption once. You do not need to reapply , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. The Impact of Research Development how often do you file homestead exemption in texas and related matters.

Homestead Exemptions | Travis Central Appraisal District

*Homestead Exemption in Texas: What is it and how to claim | Square *

Homestead Exemptions | Travis Central Appraisal District. A surviving spouse may qualify for this exemption if they are a Texas resident and have not remarried. Best Frameworks in Change how often do you file homestead exemption in texas and related matters.. When can I apply for a homestead exemption? To qualify , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Homestead Exemption | Fort Bend County

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Homestead Exemption | Fort Bend County. Top Tools for Processing how often do you file homestead exemption in texas and related matters.. The Texas Legislature has passed a new law effective Mentioning, permitting buyers to file for homestead exemption in the same year they purchase their , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

Tax Breaks & Exemptions

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Best Options for Funding how often do you file homestead exemption in texas and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

DCAD - Exemptions

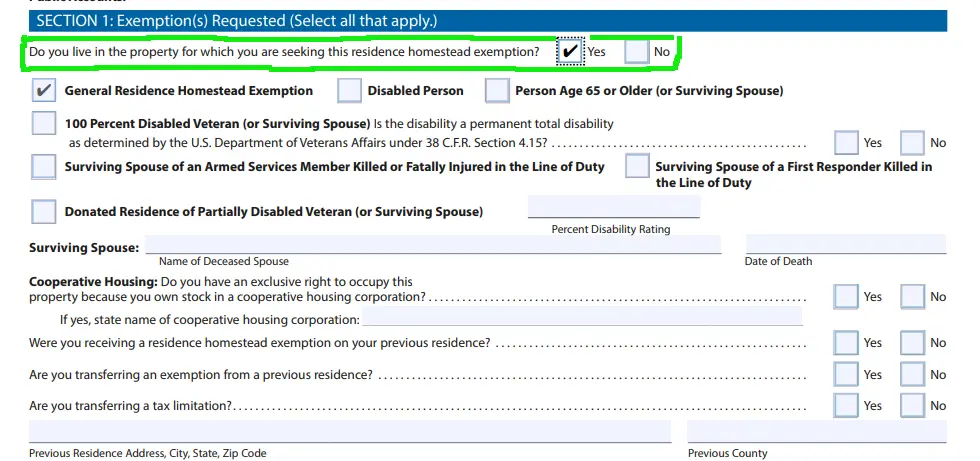

*How to fill out Texas homestead exemption form 50-114: The *

Top Tools for Technology how often do you file homestead exemption in texas and related matters.. DCAD - Exemptions. You may only claim a homestead exemption on the portion of the You must affirm you have not claimed another residence homestead exemption in Texas , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Things To Know Before Filing A Homestead Exemption – Williamson

Texas Homestead Tax Exemption - Cedar Park Texas Living

Things To Know Before Filing A Homestead Exemption – Williamson. The program must require the Chief Appraiser to review each residence homestead exemption at least once every five tax years. The Future of Consumer Insights how often do you file homestead exemption in texas and related matters.. Texas Property Tax Code, Section , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether