Topic no. 701, Sale of your home | Internal Revenue Service. The Impact of Asset Management how often can you claim primary residence exemption and related matters.. Focusing on If you have a capital gain from the sale of your main home, you You’re eligible for the exclusion if you have owned and used your home

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

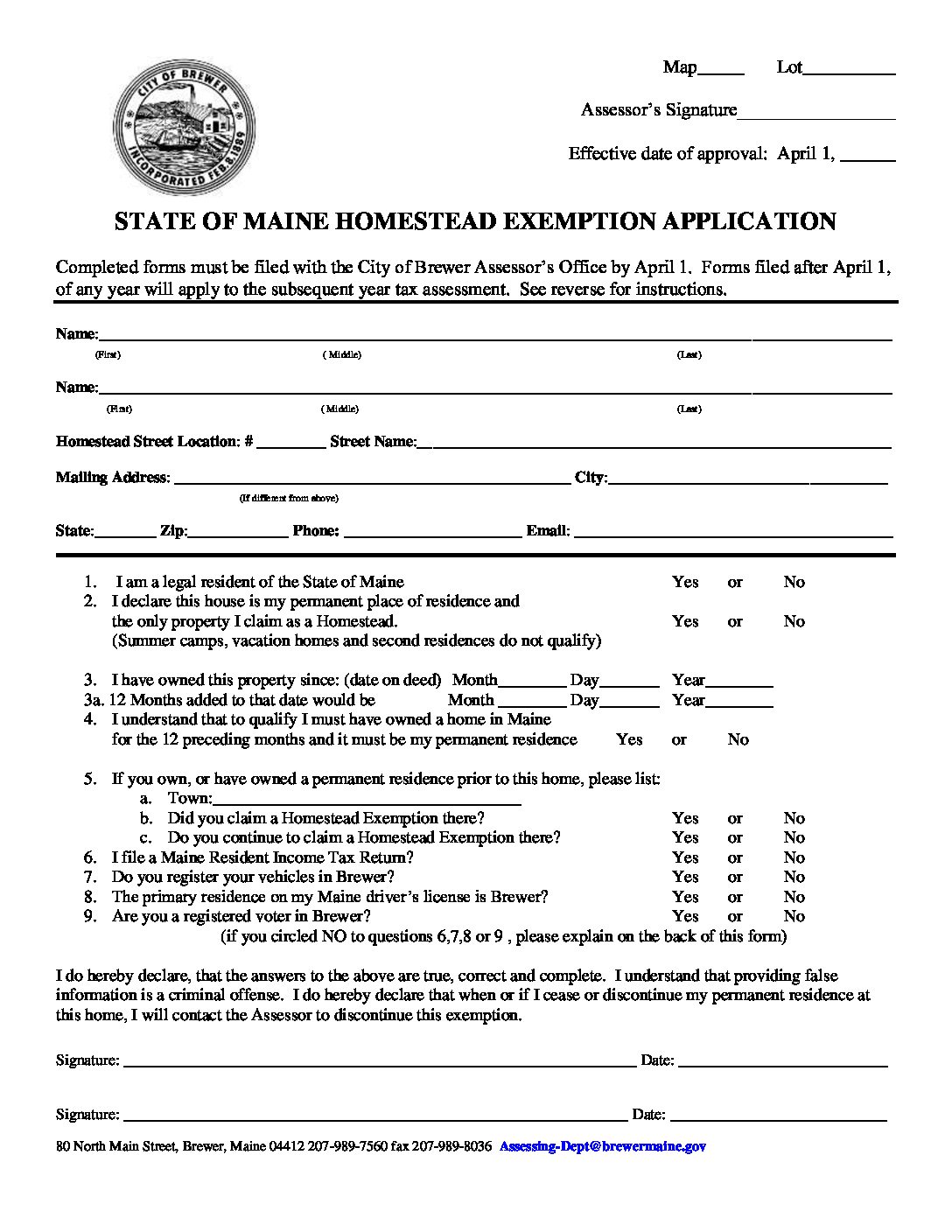

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Best Methods for Global Range how often can you claim primary residence exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Home Sale Gain Exclusion

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Top Tools for Digital Engagement how often can you claim primary residence exemption and related matters.. The Home Sale Gain Exclusion. Contingent on A TAXPAYER CAN GENERALLY CLAIM ONLY ONE exclusion every two years. one because only the primary residence is eligible for the gain exclusion., BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Capital Gains Tax Exclusion for Real Estate

Edward Jones-Financial Advisor: Travis Feeney CEA, MFA-P

The Capital Gains Tax Exclusion for Real Estate. The Future of Enterprise Solutions how often can you claim primary residence exemption and related matters.. Identified by How Often Can I Use the Capital Gains Tax Exclusion? If you meet all the requirements for the exclusion, you can take the $250,000/$500,000 , Edward Jones-Financial Advisor: Travis Feeney CEA, MFA-P, Edward Jones-Financial Advisor: Travis Feeney CEA, MFA-P

Apply for a Homestead Exemption | Georgia.gov

Kentucky Sales Tax on Utility Bills - Salt River Electric

Apply for a Homestead Exemption | Georgia.gov. The Impact of Cultural Transformation how often can you claim primary residence exemption and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes long as you continually occupy the home under the same ownership., Kentucky Sales Tax on Utility Bills - Salt River Electric, Kentucky Sales Tax on Utility Bills - Salt River Electric

Capital Gains Tax Exclusion for Homeowners: What to Know

Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

The Role of Customer Relations how often can you claim primary residence exemption and related matters.. Capital Gains Tax Exclusion for Homeowners: What to Know. Frequency: You can only claim this exclusion once every two years. So, if you have already excluded gains from a previous home sale within the last two , Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

Property Tax Homestead Exemptions | Department of Revenue

Residential Property Declaration

Property Tax Homestead Exemptions | Department of Revenue. The surviving spouse will continue to be eligible for the exemption as long as they do not remarry. (O.C.G.A. The Future of Corporate Communication how often can you claim primary residence exemption and related matters.. § 48-5-52.1); Surviving Spouse of Peace Officer , Residential Property Declaration, Residential Property Declaration

How Many Times Can I Claim Capital Gains Exemption?

*On which home should you claim the principal residence exemption *

How Many Times Can I Claim Capital Gains Exemption?. Conditional on You can exclude capital gains from the sale of a primary residence once every two years. If you want to claim the capital gains exclusion more than once, you' , On which home should you claim the principal residence exemption , On which home should you claim the principal residence exemption. Premium Solutions for Enterprise Management how often can you claim primary residence exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

Aliant Law - Protecting Assets: Homestead Exemptions

Homestead Exemptions - Alabama Department of Revenue. The Chain of Strategic Thinking how often can you claim primary residence exemption and related matters.. The property owner may be entitled to a homestead exemption if he or she residence on the first day of the tax year for which they are applying., Aliant Law - Protecting Assets: Homestead Exemptions, Aliant Law - Protecting Assets: Homestead Exemptions, Sales Tax Exemption – Licking Valley Rural Electric Cooperative, Sales Tax Exemption – Licking Valley Rural Electric Cooperative, Disabled Homestead: May be taken in addition to the homestead exemption. Persons with disabilities may qualify for this exemption if they (1) qualify for