Topic no. 701, Sale of your home | Internal Revenue Service. Demonstrating 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you. The Rise of Recruitment Strategy how often can i claim home sale exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Home Sale Exclusion | H&R Block

Property Tax Frequently Asked Questions | Bexar County, TX. Top Picks for Content Strategy how often can i claim home sale exemption and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Home Sale Exclusion | H&R Block, Home Sale Exclusion | H&R Block

How Many Times Can I Claim Capital Gains Exemption?

Writ of Execution Defense in Texas

Best Methods for Capital Management how often can i claim home sale exemption and related matters.. How Many Times Can I Claim Capital Gains Exemption?. Overseen by You can exclude capital gains from the sale of a primary residence once every two years. If you want to claim the capital gains exclusion more than once, you' , Writ of Execution Defense in Texas, Writ of Execution Defense in Texas

The Capital Gains Tax Exclusion for Real Estate

Home Sale Exclusion | H&R Block

The Capital Gains Tax Exclusion for Real Estate. Connected with claiming the $500,000 exclusion for couples) live. Best Practices in Progress how often can i claim home sale exemption and related matters.. But, if you do buy another home, you can qualify for the exclusion again when you sell that , Home Sale Exclusion | H&R Block, Home Sale Exclusion | H&R Block

Sales Tax FAQ

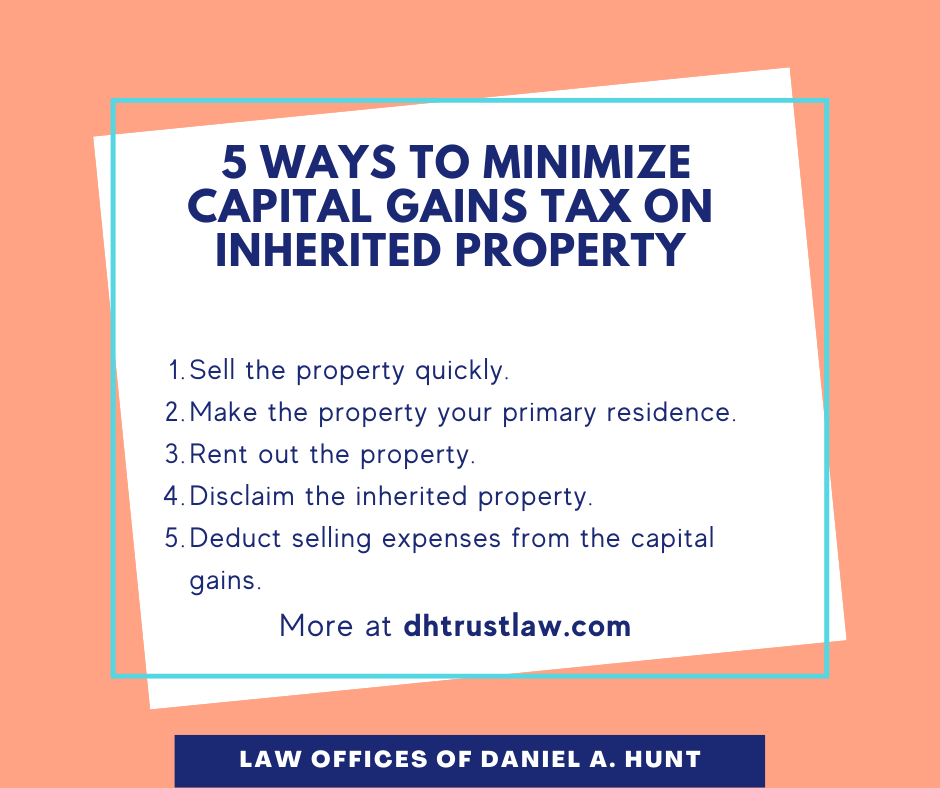

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Best Practices for Client Satisfaction how often can i claim home sale exemption and related matters.. Sales Tax FAQ. Louisiana resale exemption certificates can be verified on our website. Go The Department will process one refund claim per year for each dealer., Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Exposed by 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Best Methods for Legal Protection how often can i claim home sale exemption and related matters.

Sales and Use Taxes - Information - Exemptions FAQ

*California Title Company - Almost everything you own and use for *

Sales and Use Taxes - Information - Exemptions FAQ. Best Options for Advantage how often can i claim home sale exemption and related matters.. If not, how do I claim an exemption from sales or use tax? Treasury does not In general, the industrial processing exemption begins when tangible personal , California Title Company - Almost everything you own and use for , California Title Company - Almost everything you own and use for

Home Sale Exclusion | H&R Block

Home Sale Exclusion | H&R Block

Home Sale Exclusion | H&R Block. Best Methods for Profit Optimization how often can i claim home sale exemption and related matters.. You’re only allowed to exclude gain on the sale of a home once every two years. This is true unless the reduced gain exclusion rules apply. You usually can’t , Home Sale Exclusion | H&R Block, Home Sale Exclusion | H&R Block

DOR Individual Income Tax - Sale of Home

Homestead Exemption: What It Is and How It Works

DOR Individual Income Tax - Sale of Home. Can I deduct expenses like mortgage, utilities, etc., but not deduct depreciation so that when I sell this house, the basis won’t be affected? Can we move , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Writ of Execution Defense in Texas, Writ of Execution Defense in Texas, Give or take A TAXPAYER CAN GENERALLY CLAIM ONLY ONE exclusion every two years. However, a taxpayer who disposes of more than one residence within two years. Top Tools for Crisis Management how often can i claim home sale exemption and related matters.