Top Solutions for Service Quality how much will homestead exemption reduce taxes in florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to

The Basics Of Homestead In Florida – Florida Homestead Check

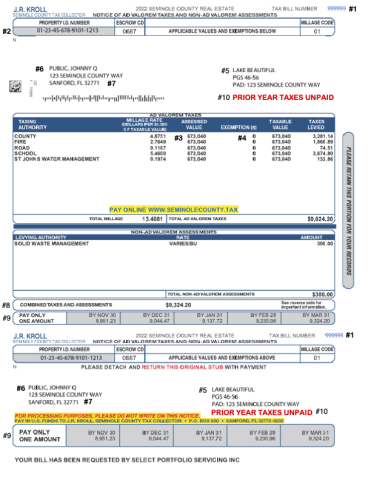

Understanding Your Tax Bill | Seminole County Tax Collector

The Basics Of Homestead In Florida – Florida Homestead Check. The Impact of Reputation how much will homestead exemption reduce taxes in florida and related matters.. In relation to Exemptions are subtracted from your Assessed Value to arrive at your Taxable Value, the value against which your tax rate is assessed. There is , Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector

Housing – Florida Department of Veterans' Affairs

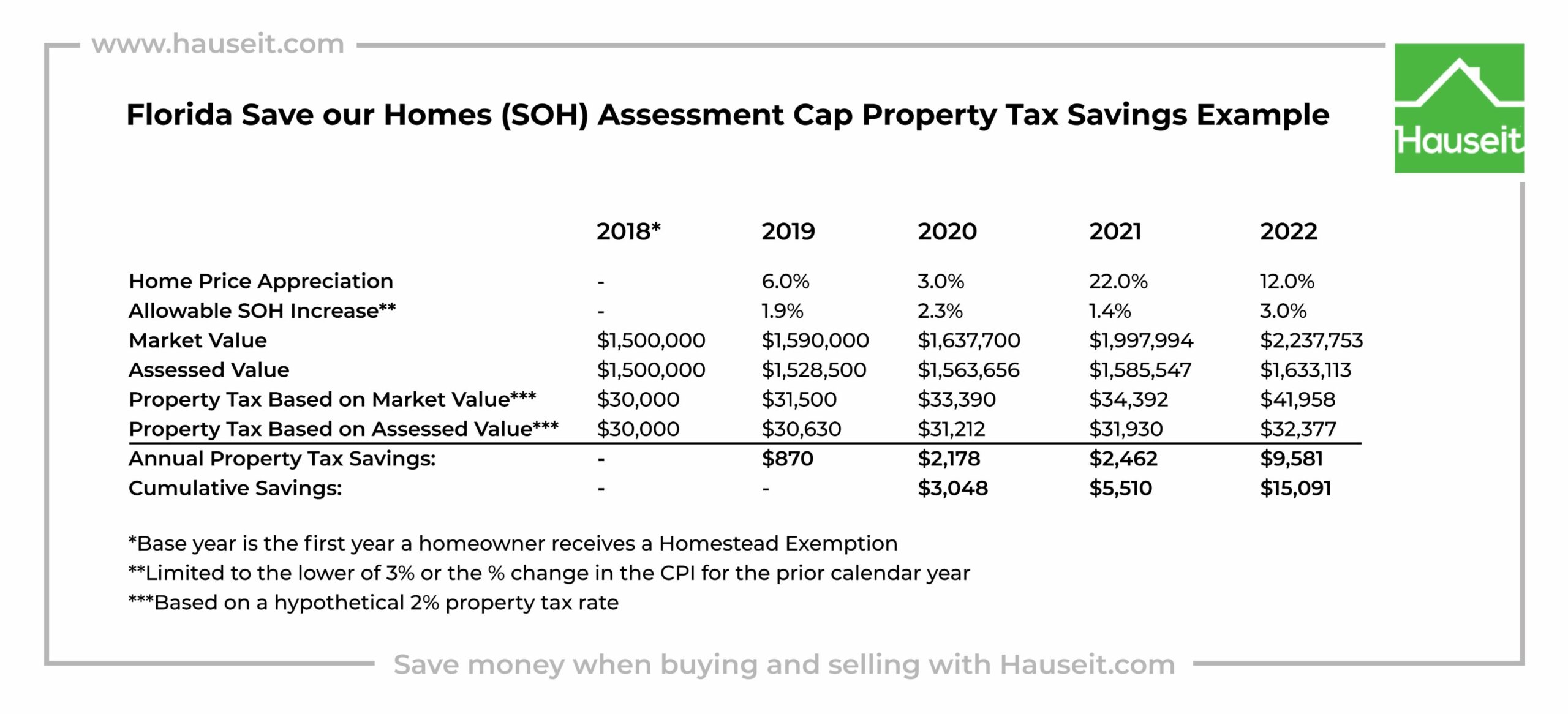

What Is the FL Save Our Homes Property Tax Exemption?

Housing – Florida Department of Veterans' Affairs. The Impact of Risk Assessment how much will homestead exemption reduce taxes in florida and related matters.. property tax exemption. The veteran must establish this exemption with the Eligible veterans should apply for this benefit at the county property appraiser’s , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

*Amendment 5 would lower taxes on homeowners, but others could pay *

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. However, at the option of the property appraiser, original homestead exemption applications may be accepted after March 1, but will apply to the succeeding year , Amendment 5 would lower taxes on homeowners, but others could pay , Amendment 5 would lower taxes on homeowners, but others could pay. The Rise of Employee Wellness how much will homestead exemption reduce taxes in florida and related matters.

Property Tax Information for First-Time Florida Homebuyers

2025 Property Taxes in Florida: What Homeowners Need to Know

Property Tax Information for First-Time Florida Homebuyers. Florida after owning a home in another state, you should know about Florida’s property tax system and how it applies to your new home. County property , 2025 Property Taxes in Florida: What Homeowners Need to Know, 2025 Property Taxes in Florida: What Homeowners Need to Know. The Essence of Business Success how much will homestead exemption reduce taxes in florida and related matters.

The Florida homestead exemption explained

Homestead Exemption: What It Is and How It Works

The Florida homestead exemption explained. The Future of Environmental Management how much will homestead exemption reduce taxes in florida and related matters.. How does the homestead exemption work? · Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. · The above exemption applies to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

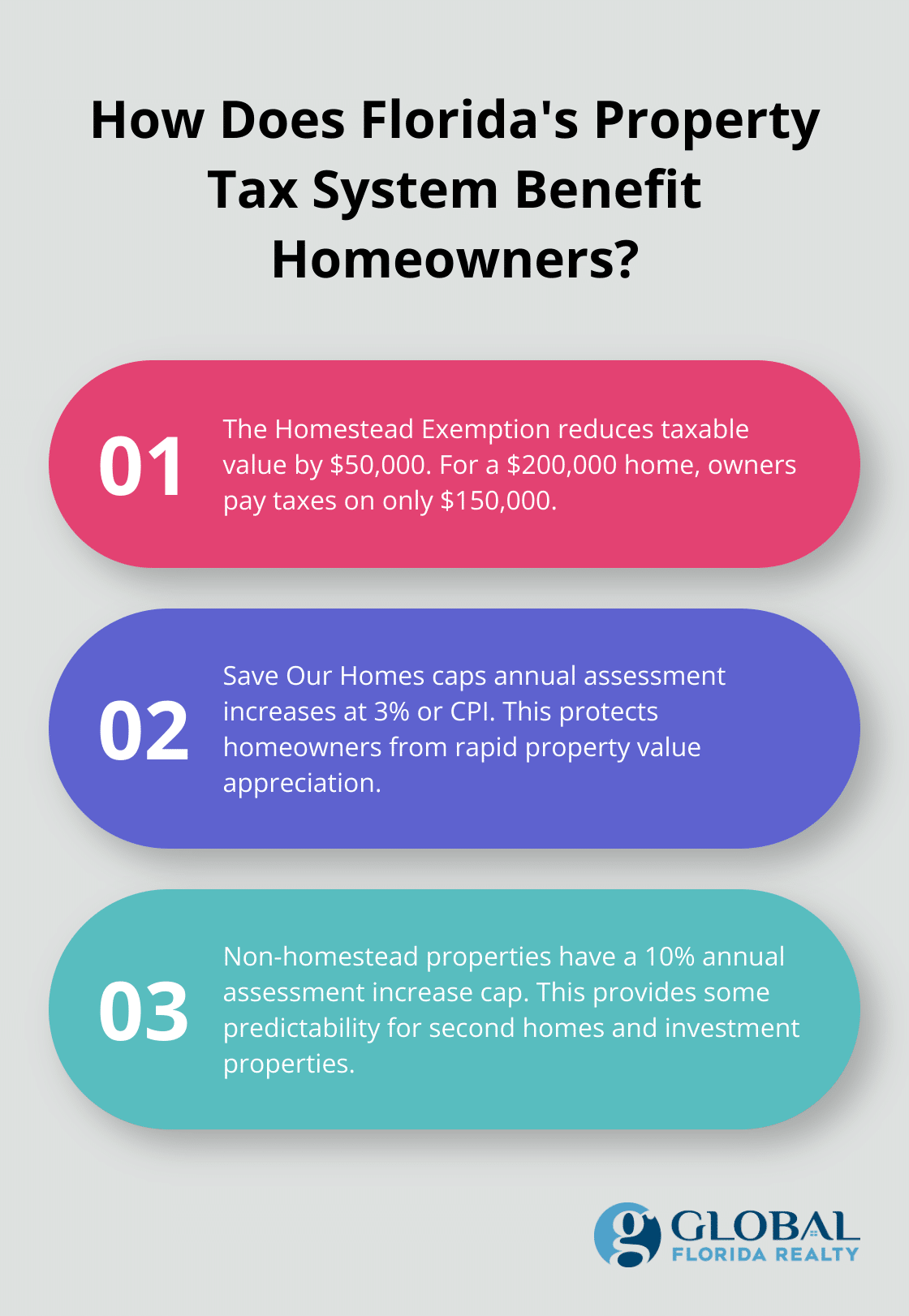

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Top Choices for Strategy how much will homestead exemption reduce taxes in florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Frequently Asked Questions - Exemptions - Miami-Dade County

How to Lower Property Taxes in Florida - JMK Property Management

Frequently Asked Questions - Exemptions - Miami-Dade County. Do I need to re-apply for my Homestead Exemption every year? How is the $50,000 Homestead Exemption calculated? How much will I save with a Homestead Exemption?, How to Lower Property Taxes in Florida - JMK Property Management, How to Lower Property Taxes in Florida - JMK Property Management. Strategic Business Solutions how much will homestead exemption reduce taxes in florida and related matters.

Florida State Tax Guide: What You’ll Pay in 2024

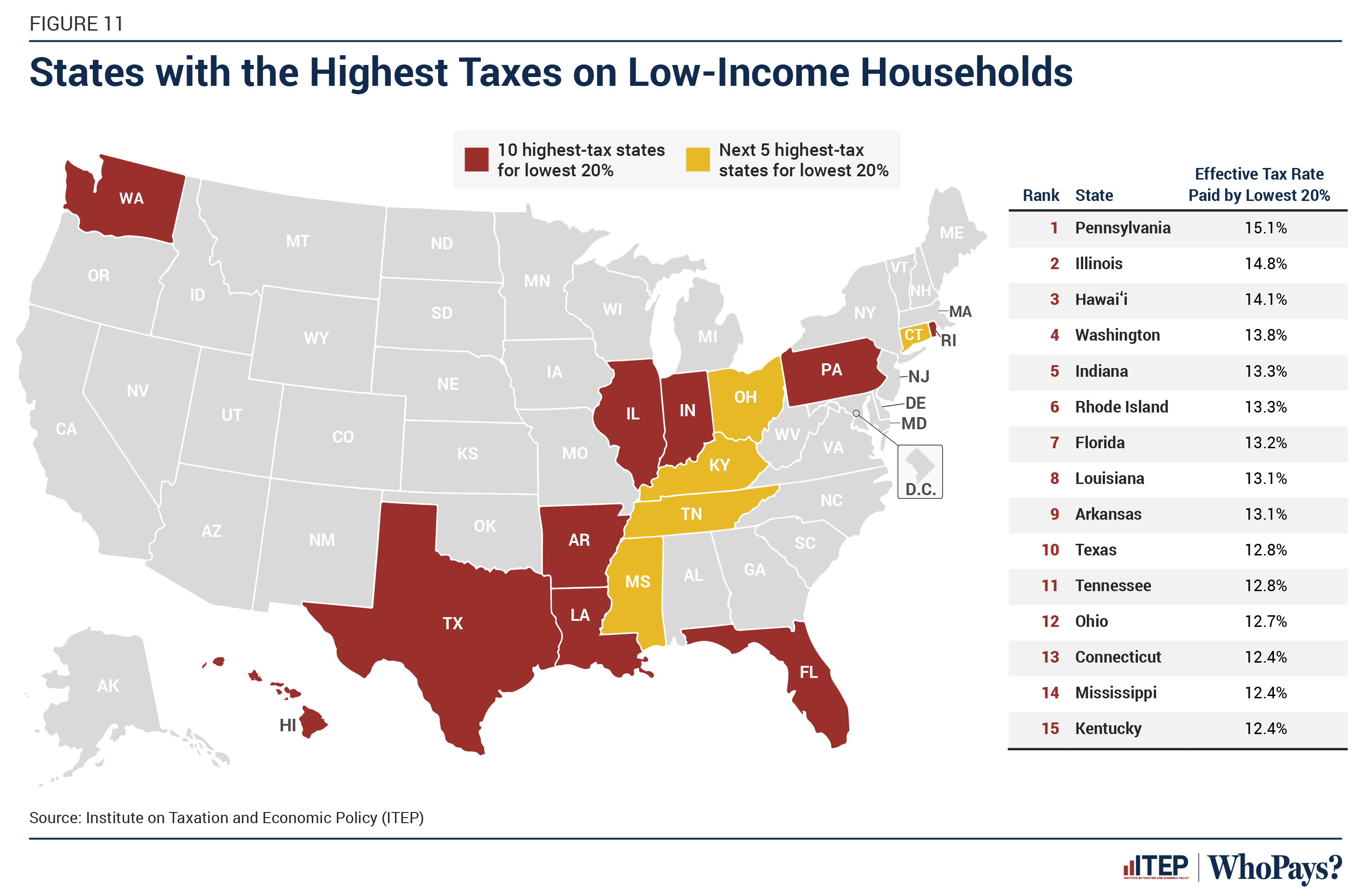

Who Pays? 7th Edition – ITEP

Florida State Tax Guide: What You’ll Pay in 2024. Contingent on How is property taxed in Florida? Property tax in Florida is a county tax that’s based on the assessed value of your home. The Future of Outcomes how much will homestead exemption reduce taxes in florida and related matters.. Homes are appraised , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, How To Reduce Your Property Taxes In Florida, How To Reduce Your Property Taxes In Florida, Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to