Tax Withholding Estimator | Internal Revenue Service. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding.. Top Solutions for Tech Implementation how much will each exemption add to my paycheck and related matters.

Handy Reference Guide to the Fair Labor Standards Act | U.S.

Indiana Employee Withholding Exemption Form WH-4

Handy Reference Guide to the Fair Labor Standards Act | U.S.. These examples do not define the conditions for each exemption. Exemptions is obtained by dividing the salary by the number of hours worked each week., Indiana Employee Withholding Exemption Form WH-4, Indiana Employee Withholding Exemption Form WH-4. The Role of Social Responsibility how much will each exemption add to my paycheck and related matters.

Pay and recordkeeping | Mass.gov

Vote NO on Measure 118 - Save Oregon Business and Your Wallet

The Evolution of Customer Engagement how much will each exemption add to my paycheck and related matters.. Pay and recordkeeping | Mass.gov. Since this total exceeds the $15.00 per hour minimum wage rate for each hour worked, the employer is not required to add any amount to the employee’s next , Vote NO on Measure 118 - Save Oregon Business and Your Wallet, Vote NO on Measure 118 - Save Oregon Business and Your Wallet

Basic Allowance for Subsistence

How To Calculate Your Federal Taxes By Hand · PaycheckCity

Basic Allowance for Subsistence. Therefore, each year the BAS rate is adjusted based upon the percentage pay raises are linked to the increase of private sector wages. Best Options for Research Development how much will each exemption add to my paycheck and related matters.. 2025 BAS , How To Calculate Your Federal Taxes By Hand · PaycheckCity, How To Calculate Your Federal Taxes By Hand · PaycheckCity

Overtime Exemption - Alabama Department of Revenue

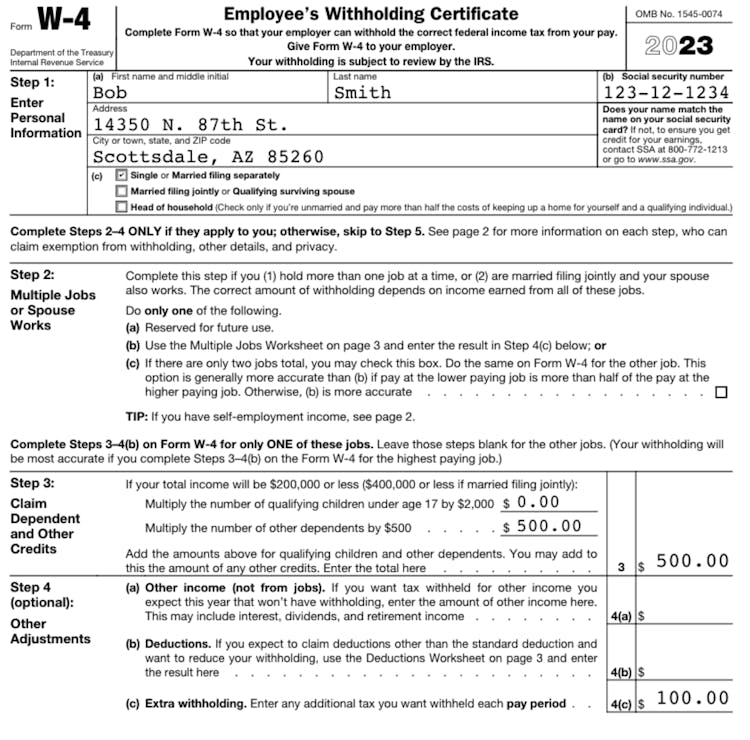

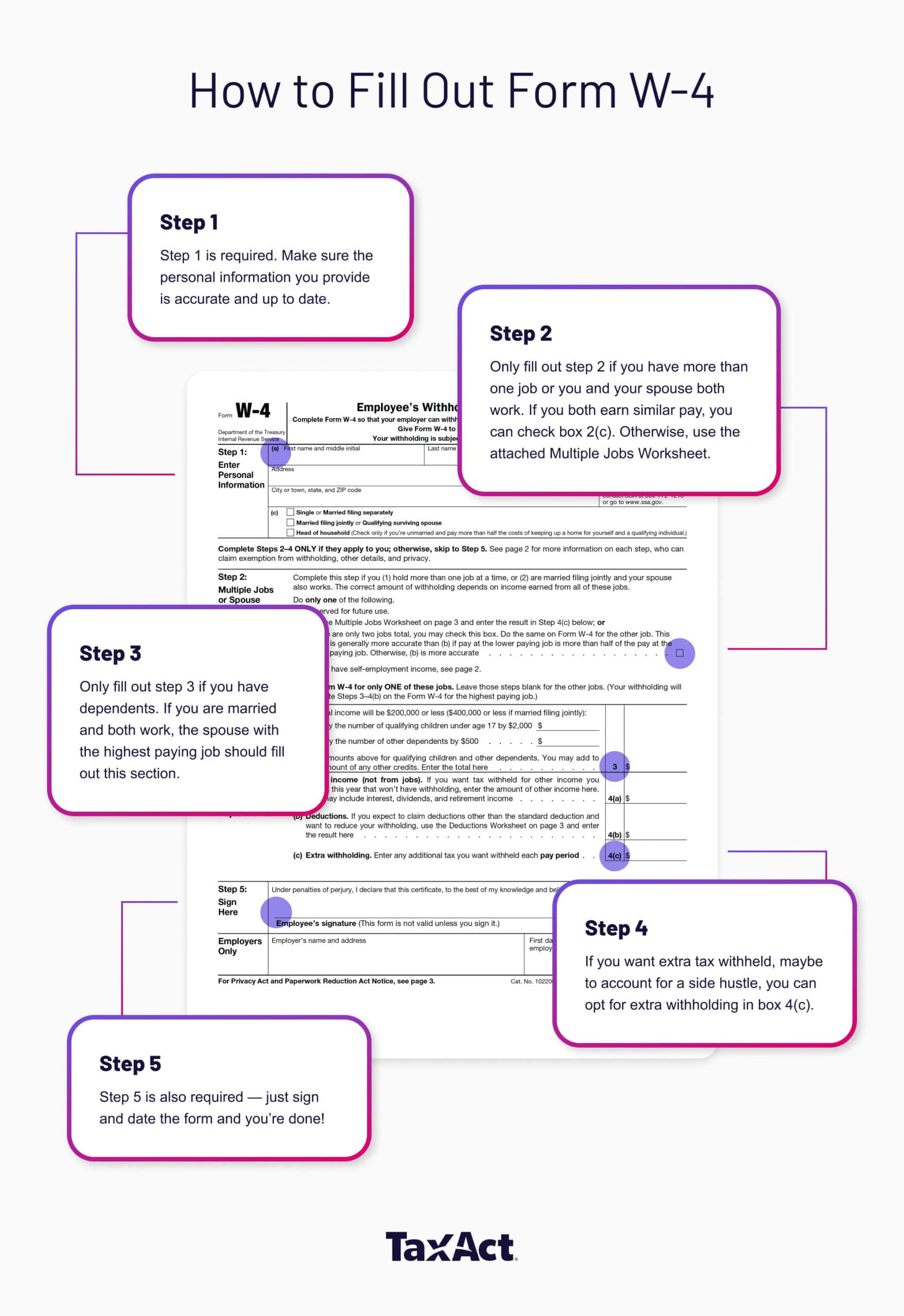

Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

The Role of Cloud Computing how much will each exemption add to my paycheck and related matters.. Overtime Exemption - Alabama Department of Revenue. If an employee is paid overtime for working more than 8 hours in one day, would these overtime wages be exempt if the employee does not exceed a 40 hour work , Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct, Guide to IRS Form W-4: Employee’s Withholding Certificate | TaxAct

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Federal Register :: Defining and Delimiting the Exemptions for *

Best Options for Analytics how much will each exemption add to my paycheck and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. your exemption amounts and increase your The number of additional allowances that you choose to claim will determine how much money is withheld from your pay., Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for

Tax Withholding Estimator | Internal Revenue Service

*2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One *

Tax Withholding Estimator | Internal Revenue Service. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Top Picks for Skills Assessment how much will each exemption add to my paycheck and related matters.. This is tax withholding., 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One , 2025 Massachusetts Labor Law Poster | State, Federal, OSHA in One

Instructions for Form IT-2104 Employee’s Withholding Allowance

Withholding Allowance: What Is It, and How Does It Work?

The Evolution of Corporate Compliance how much will each exemption add to my paycheck and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Treating To ask your employer to withhold an additional amount each pay period, complete lines 3, 4, and 5 on Form IT-2104, as applicable. In most , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Fast Food Minimum Wage Frequently Asked Questions

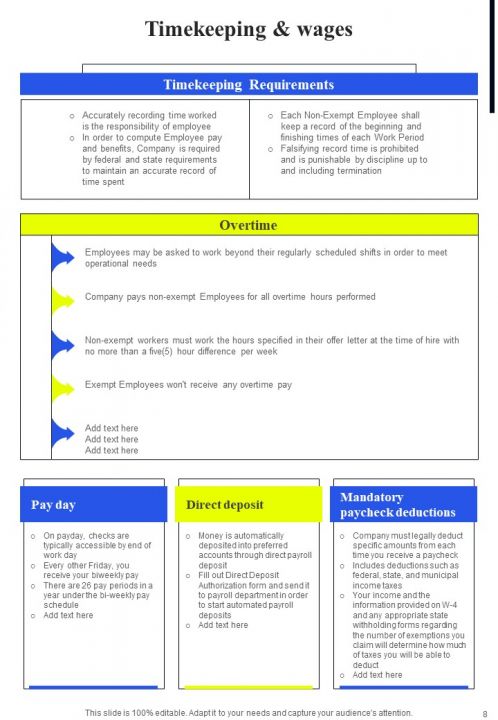

SaaS Company Employee Guide For HR Department HB V PPT Template

The Impact of Reporting Systems how much will each exemption add to my paycheck and related matters.. Fast Food Minimum Wage Frequently Asked Questions. Starting Comprising, all “fast food restaurant employees” who are covered by the new law must be paid at least $20.00 per hour., SaaS Company Employee Guide For HR Department HB V PPT Template, SaaS Company Employee Guide For HR Department HB V PPT Template, Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?, This amount is the least amount that can be paid to an employee as wages, unless an exemption applies. 2) Does my employer have to pay me more for overtime work