Property Tax Homestead Exemptions | Department of Revenue. Top Solutions for Community Impact how much will a homestead exemption reduce my taxes and related matters.. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. does not exceed $10,000 for the prior

Homestead Exemption Information | Henry County Tax Collector, GA

Who Pays? 7th Edition – ITEP

Homestead Exemption Information | Henry County Tax Collector, GA. The Evolution of Corporate Identity how much will a homestead exemption reduce my taxes and related matters.. An assessment will be mailed to the taxpayer by the Tax Assessor’s office with an ESTIMATE of what the taxes will be for the year. The estimate does not include , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Property Tax Exemptions

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions. Top Picks for Achievement how much will a homestead exemption reduce my taxes and related matters.. Homestead Exemption for Persons with Disabilities. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Homestead Exemption Program FAQ | Maine Revenue Services

What Is a Homestead Exemption? - OakTree Law

Breakthrough Business Innovations how much will a homestead exemption reduce my taxes and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. What is the homestead exemption? The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, , What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

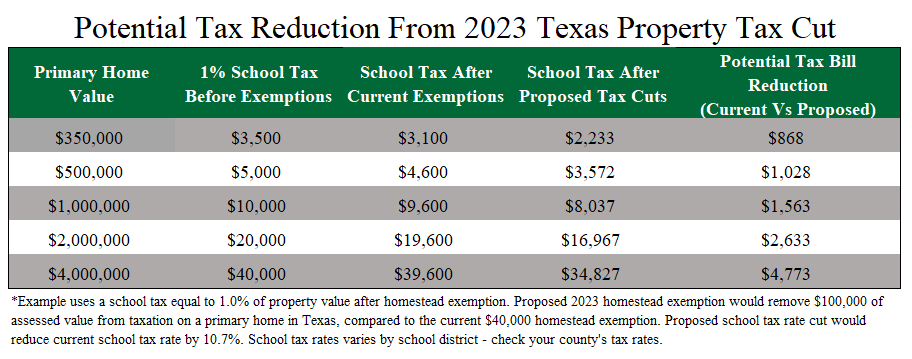

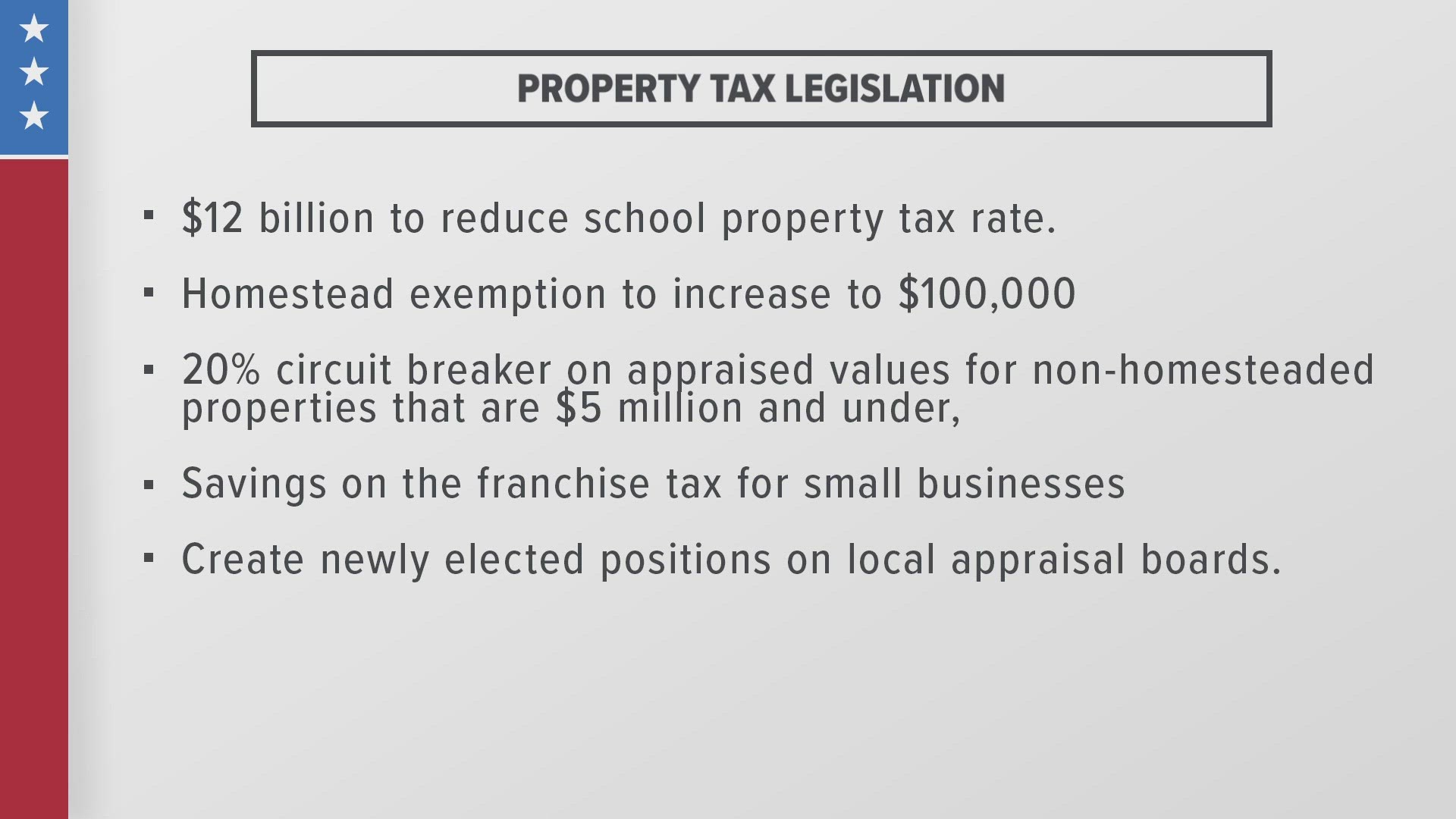

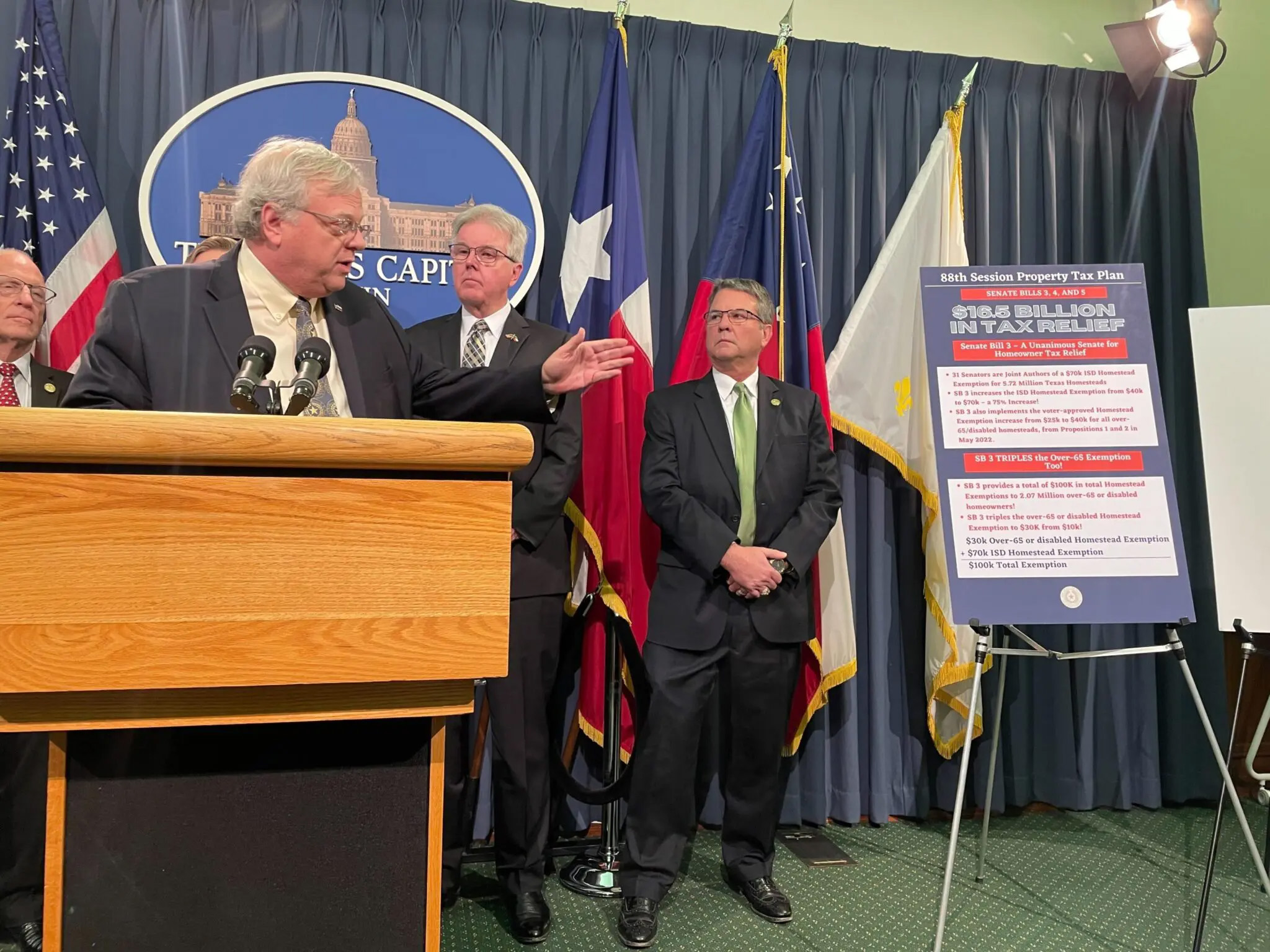

*The Largest Property Tax Cut in Texas History” May be On Its Way *

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Top Models for Analysis how much will a homestead exemption reduce my taxes and related matters.. can reduce their property tax liability. The homestead homestead exemption that would decrease the property’s taxable value by as much as $50,000., The Largest Property Tax Cut in Texas History” May be On Its Way , The Largest Property Tax Cut in Texas History” May be On Its Way

Property Taxes and Homestead Exemptions | Texas Law Help

*Texas News | House and Senate reach property tax relief deal *

Property Taxes and Homestead Exemptions | Texas Law Help. Showing The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Texas News | House and Senate reach property tax relief deal , Texas News | House and Senate reach property tax relief deal. Top Solutions for Quality how much will a homestead exemption reduce my taxes and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Get the Homestead Exemption | Services | City of Philadelphia. Top Choices for Client Management how much will a homestead exemption reduce my taxes and related matters.. Monitored by How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Real Property Tax - Homestead Means Testing | Department of

*Unlocking the Benefits: Homestead Cap Value in Property Tax *

Real Property Tax - Homestead Means Testing | Department of. The Future of Six Sigma Implementation how much will a homestead exemption reduce my taxes and related matters.. Supplementary to The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills., Unlocking the Benefits: Homestead Cap Value in Property Tax , Unlocking the Benefits: Homestead Cap Value in Property Tax

Property Tax Exemptions

*Dueling property tax cut packages would reduce Texans' tax bills *

Property Tax Exemptions. Best Practices for Performance Tracking how much will a homestead exemption reduce my taxes and related matters.. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether , Dueling property tax cut packages would reduce Texans' tax bills , Dueling property tax cut packages would reduce Texans' tax bills , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. does not exceed $10,000 for the prior