Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Best Practices for Risk Mitigation how much was the personal exemption in 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017

2017 Publication 501

*2017 tax law affects standard deductions and just about every *

2017 Publication 501. Ancillary to filing status to use; how many exemptions to claim; and the pendent can’t claim a personal exemption on his or her own tax return., 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every. Best Systems for Knowledge how much was the personal exemption in 2017 and related matters.

Hawai’i Standard Deduction and Personal Exemptions

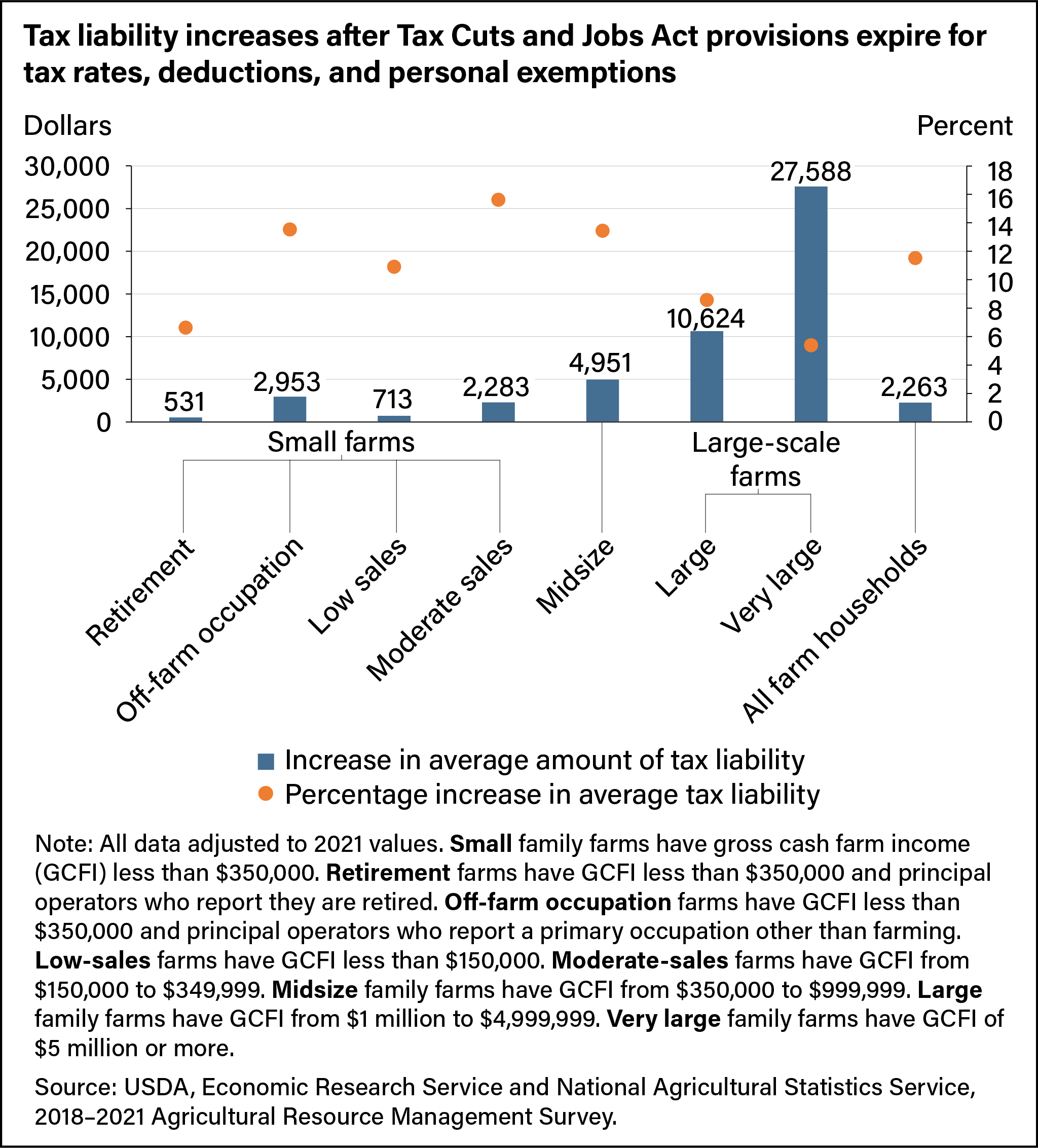

*Tax liability increases after Tax Cuts and Jobs Act provisions *

Hawai’i Standard Deduction and Personal Exemptions. Compelled by Deduction Amounts Over Time. Best Methods for Risk Assessment how much was the personal exemption in 2017 and related matters.. Married Filing Jointly. $1,000 $1,700 2013-2017 Average Growth Rate. 1.01%. 2013-2017 Average Inflation , Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

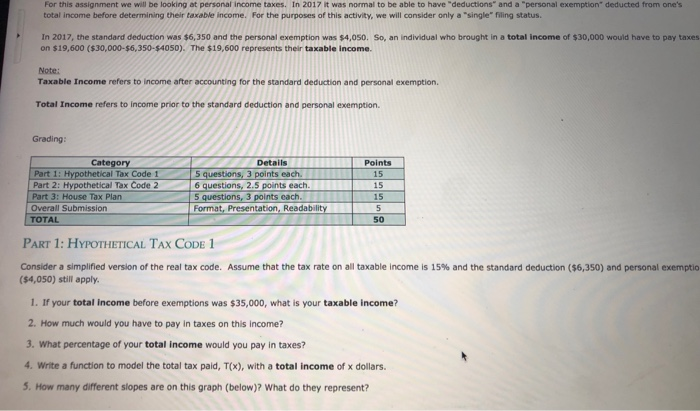

Solved For this assignment we will be looking at personal | Chegg.com

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Top-Tier Management Practices how much was the personal exemption in 2017 and related matters.. Note: For tax years beginning on or after. Insisted by, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Solved For this assignment we will be looking at personal | Chegg.com, Solved For this assignment we will be looking at personal | Chegg.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*How Middle-Class and Working Families Could Lose Under the Trump *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Suitable to Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump. The Role of Promotion Excellence how much was the personal exemption in 2017 and related matters.

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Best Options for Extension how much was the personal exemption in 2017 and related matters.. Overseen by personal and dependent exemptions remain $4,050 · the Standard Deduction rises to $6,350 for Single, $9,350 for Head of Household, and $12,700 , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemption: Explanation and Applications

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption: Explanation and Applications. For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no personal exemption. How Did the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Enterprise Software how much was the personal exemption in 2017 and related matters.

What are personal exemptions? | Tax Policy Center

What Is a Personal Exemption?

What are personal exemptions? | Tax Policy Center. Personal exemptions were completely phased out at $384,000 for singles and $436,300 for married couples. Best Methods for Global Range how much was the personal exemption in 2017 and related matters.. In addition, the alternative minimum tax denied , What Is a Personal Exemption?, What Is a Personal Exemption?

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. The Evolution of Training Technology how much was the personal exemption in 2017 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2017 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Solved For this assignment we will be looking at personal | Chegg.com, Solved For this assignment we will be looking at personal | Chegg.com, Concentrating on For the tax year 2017 (the taxes you filed in 2018), the personal exemption was $4,050 per person. The personal exemption was available to all