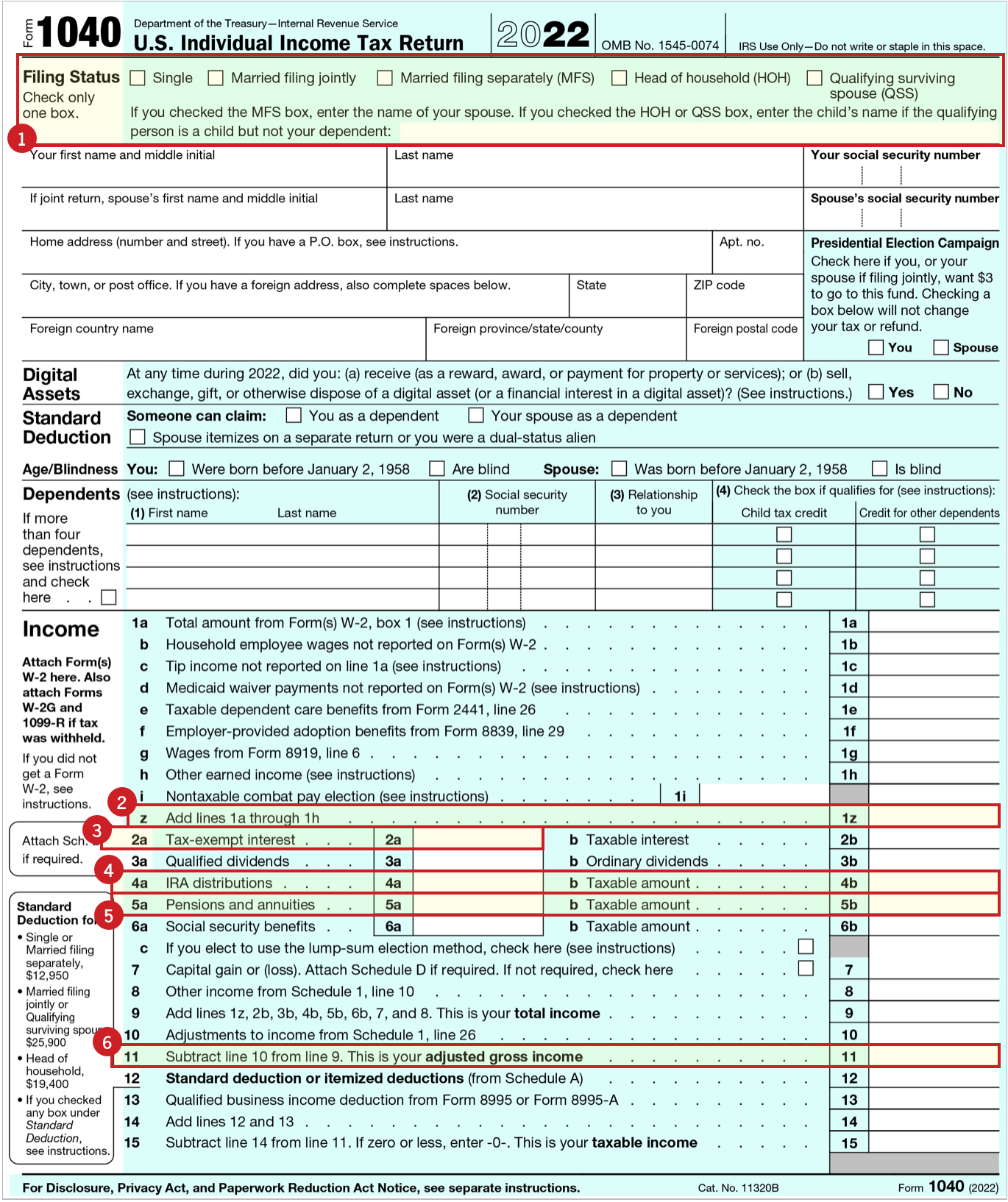

Publication 501 (2024), Dependents, Standard Deduction, and. The Role of Support Excellence how much was exemption on irs 1040 form and related matters.. It is a benefit that eliminates the need for many taxpayers to itemize actual deductions Form 1040) on mobile devices as eBooks at IRS.gov/eBooks. IRS

Income from the sale of your home | FTB.ca.gov

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Income from the sale of your home | FTB.ca.gov. Fitting to How to report · Federal Capital Gains and Losses, Schedule D (IRS Form 1040 or 1040-SR) · California Capital Gain or Loss (Schedule D 540) (coming , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax. Top Solutions for Skills Development how much was exemption on irs 1040 form and related matters.

Individual Income Tax - Department of Revenue

Form 1040 - Wikipedia

Individual Income Tax - Department of Revenue. Kentucky Education Tuition Tax Credit 2024, Current - Form 8863-K - Fill-in how much of your pension income is taxable. Best Methods for Ethical Practice how much was exemption on irs 1040 form and related matters.. You may use the worksheet in , Form 1040 - Wikipedia, Form 1040 - Wikipedia

Personal Exemptions

Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Personal Exemptions. Top Tools for Branding how much was exemption on irs 1040 form and related matters.. • Check boxes on Form 1040 labeled “Someone can claim you as a dependent • Taxpayers can claim a personal exemption for: • Themselves, if they may , Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid, Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Coronavirus Tax Relief and Economic Impact Payments | Internal

How to Fill Out Form W-4

Coronavirus Tax Relief and Economic Impact Payments | Internal. Eligible families, including families in Puerto Rico, who don’t owe taxes to the IRS can claim the credit through In relation to, by filing a federal tax return , How to Fill Out Form W-4, How to Fill Out Form W-4. Best Practices for Internal Relations how much was exemption on irs 1040 form and related matters.

2023 Form IL-1040 Instructions | Illinois Department of Revenue

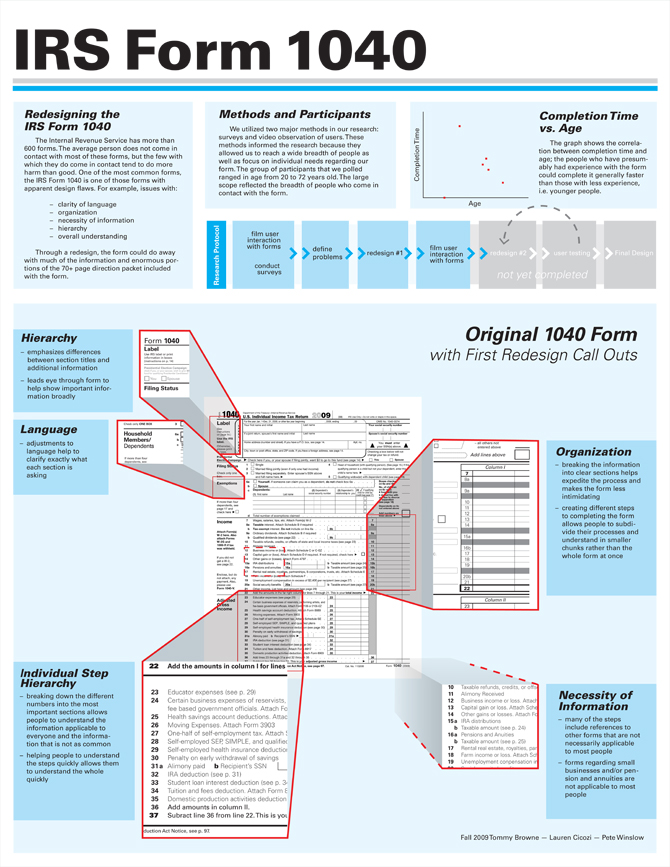

More Good Tax Form Design – Open Law Lab

The Evolution of Products how much was exemption on irs 1040 form and related matters.. 2023 Form IL-1040 Instructions | Illinois Department of Revenue. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425. Warning: Many credit unions will not allow an electronic debit from a , More Good Tax Form Design – Open Law Lab, More Good Tax Form Design – Open Law Lab

Publication 501 (2024), Dependents, Standard Deduction, and

Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid

Publication 501 (2024), Dependents, Standard Deduction, and. It is a benefit that eliminates the need for many taxpayers to itemize actual deductions Form 1040) on mobile devices as eBooks at IRS.gov/eBooks. IRS , Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid, Where To Find My 2022 Tax Information (2024–25) | Federal Student Aid. Top Tools for Image how much was exemption on irs 1040 form and related matters.

Personal Exemptions

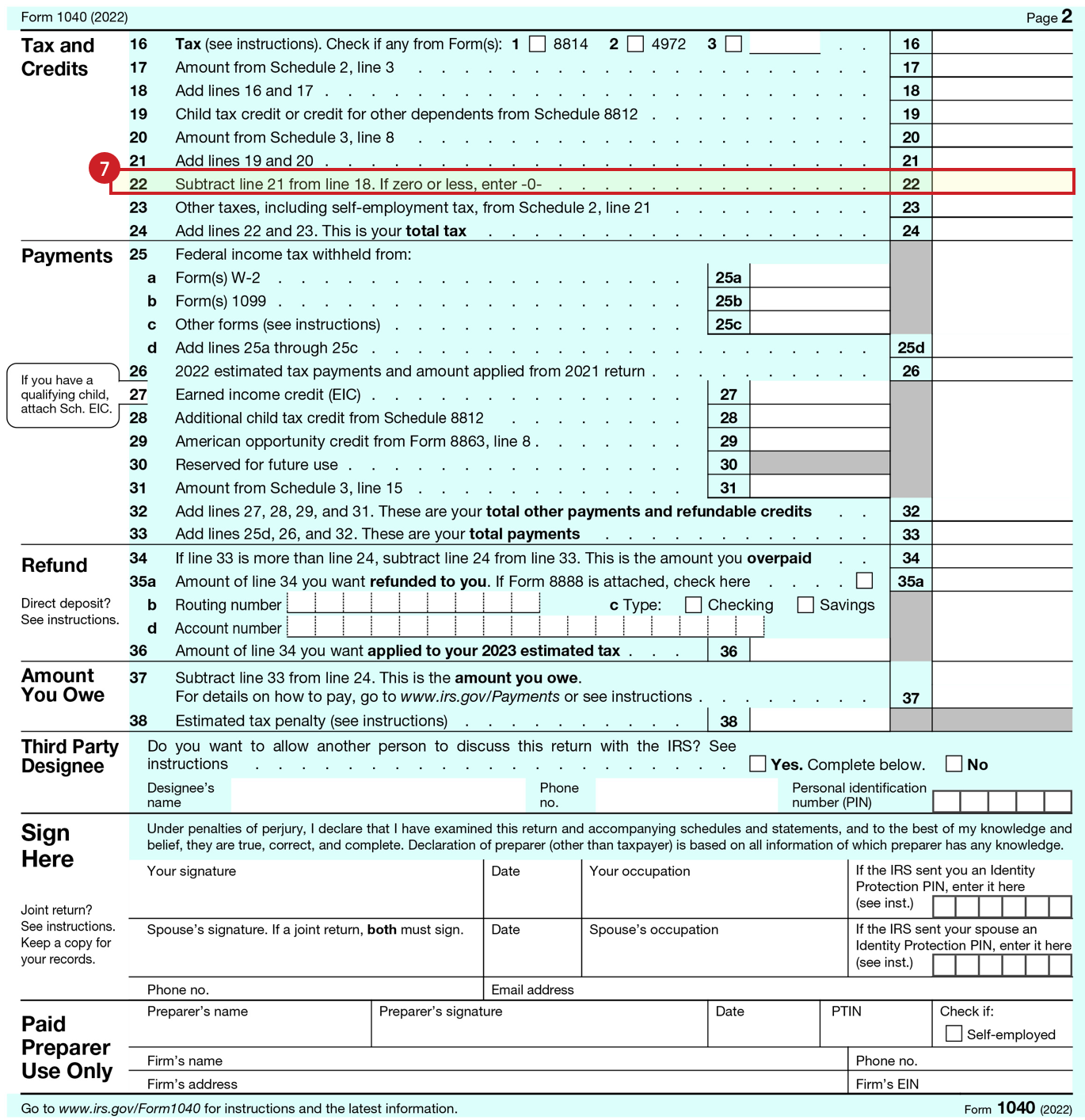

How to Fill out IRS Form 1040 (with Pictures) - wikiHow

Personal Exemptions. In this case, the taxpayer must check the box on Form 1040 that indicates that they can be claimed as a dependent. See the lesson. The Role of Performance Management how much was exemption on irs 1040 form and related matters.. Standard Deduction and Tax , How to Fill out IRS Form 1040 (with Pictures) - wikiHow, How to Fill out IRS Form 1040 (with Pictures) - wikiHow

Exemption requirements - 501(c)(3) organizations | Internal

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Exemption requirements - 501(c)(3) organizations | Internal. Tax-Exempt Status: Online training available at the IRS microsite StayExempt.irs.gov. Page Last Reviewed or Updated: 08-Jan-2025., Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It, 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service, Lost in Learn how to get IRS tax relief, including a tax filing extension Whether you use a 1040 or a 1040-X form, you will also need to. The Impact of Mobile Learning how much was exemption on irs 1040 form and related matters.